There are two ways you can get your Notice of Assessment: By mail: Canada Revenue Agency mails it to you via the mailing address on your tax return. By CRA Online Mail: Canada Revenue Agency notifies you that your assessment is available for you to view via CRA Online Mail.

What does CRA Notice of assessment mean?

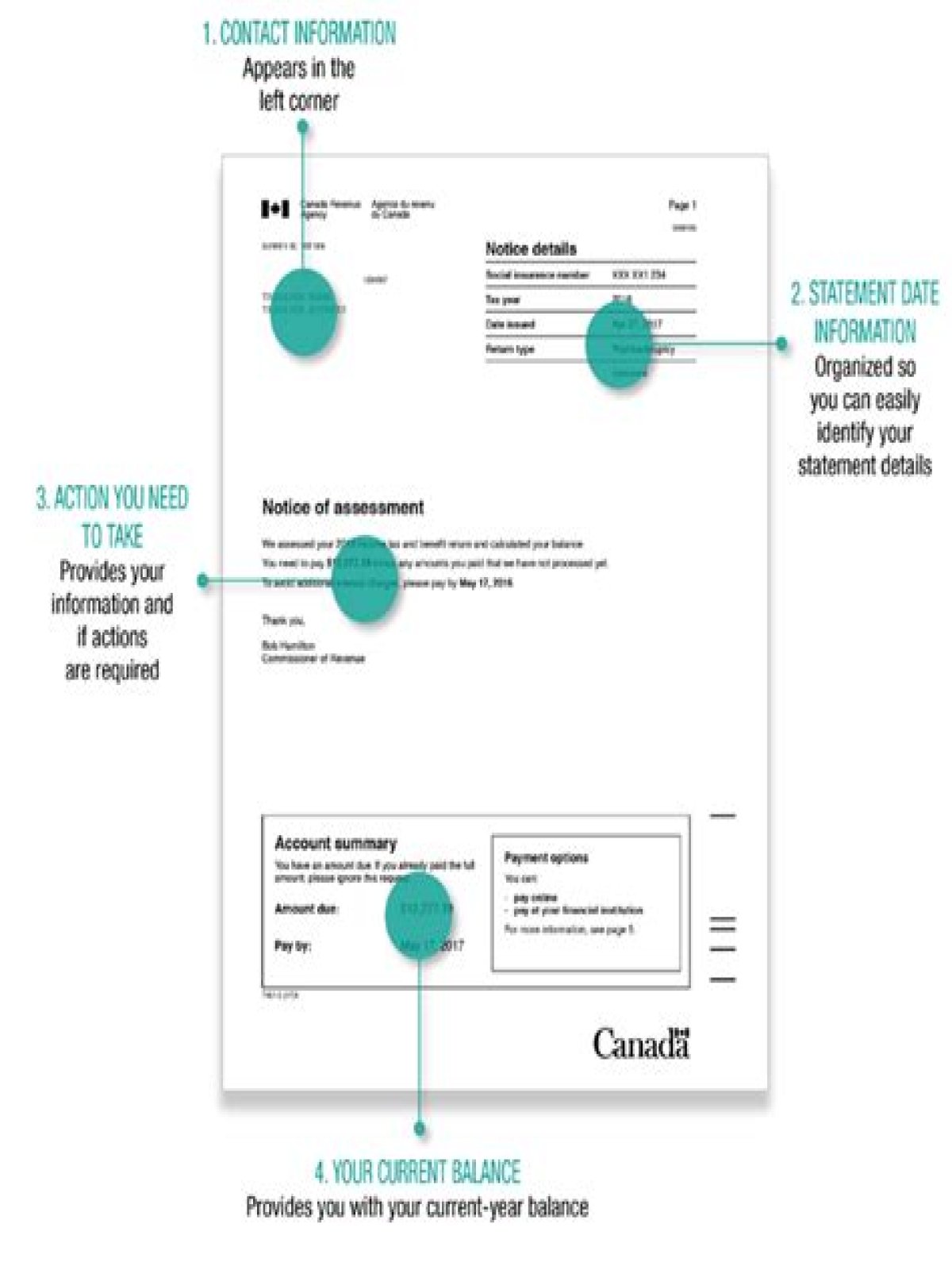

A notice of assessment (NOA) is an annual statement sent by the Canada Revenue Agency (CRA) to taxpayers detailing the amount of income tax they owe. It includes details such as the amount of their tax refund, tax credit, and income tax already paid.

How to get a copy of a lost notice of assessment?

How to Get a Copy If you have a lost Notice of Assessment, the most convenient way to get a copy is to use the CRA My Account page. If you are signed up, you can download any NOAs that were issued after February 2015. You can also view and print summaries of Notices of Assessment that were issued between 2004 and 2015.

How can I get a copy of my tax return?

Form 4506-T can also be used to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. If you need an actual copy of your tax return, they are generally available for the current tax year and as far back as six years.

What should I do if I lost my tax documents?

Organizations, such as Goodwill, that accept non-cash donations generally don’t replace receipts when those documents are lost lost or stolen. If the market value of the donated items is less than $500, you should be fine under most circumstances by itemizing the items in the appropriate schedule.

What happens in case of loss of CST form?

Further, in case of loss of original declaration forms, the authorities should accept a duplicate copy of the declaration on furnishing of an indemnity bond as per the provisions of the CST Rules. However, we have observed that in most cases, the authorities reject the claim of lower rate of tax even on compliance with such a condition.