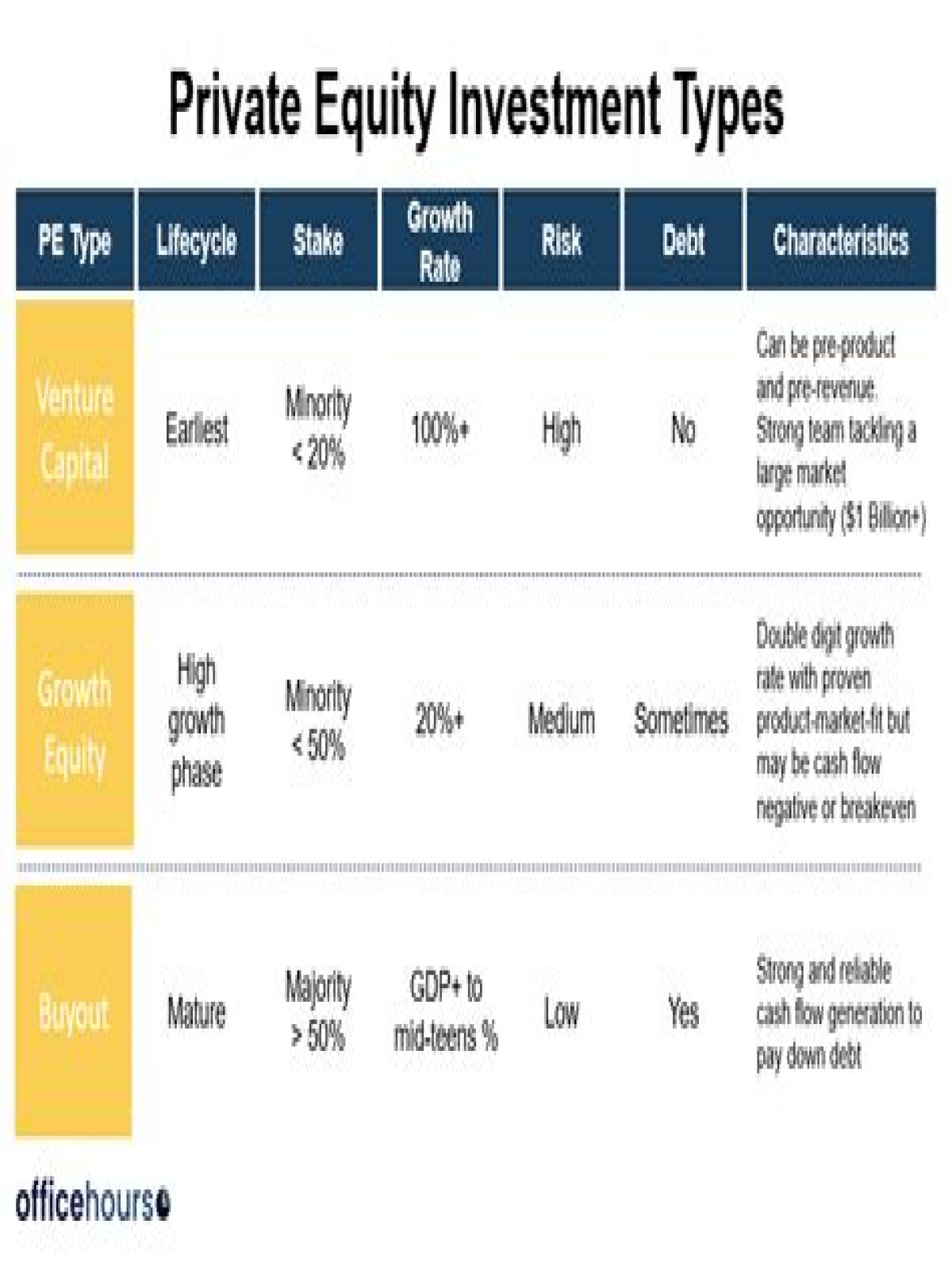

There are three key types of private equity strategies: venture capital, growth equity, and buyouts. These strategies don’t compete against one another and require different skills to be successful, yet each has a place in an organization’s life cycle.

Who are participants in private equity industry?

Investors who are contributing capital to private equity firms. These may include public and corporate pension funds, endowments, foundations, bank holding companies, investment banks, insurance companies and wealthy families and individuals.

How many private equity firms are there?

And consider the growth in US PE- backed companies, which numbered about 4,000 in 2006. By 2017, that figure rose to about 8,000, a 106 percent increase. Meanwhile, US publicly traded firms fell by 16 percent from 5,100 to 4,300 (and by 46 percent since 1996).

What is the point of private equity?

Private equity firms make money by charging management and performance fees from investors in a fund. Among the advantages of private equity are easy access to alternate forms of capital for entrepreneurs and company founders and less stress of quarterly performance.

What is a good return for private equity?

Private equity produced average annual returns of 10.48% over the 20-year period ending on June 30, 2020. Between 2000 and 2020, private equity outperformed the Russell 2000, the S&P 500, and venture capital. When compared over other time frames, however, private equity returns can be less impressive.

What is the biggest fund in the world?

Rankings by Total Assets

| Rank | Profile | Region |

|---|---|---|

| 1. | Norway Government Pension Fund Global | Europe |

| 2. | China Investment Corporation | Asia |

| 3. | Kuwait Investment Authority | Middle East |

| 4. | Abu Dhabi Investment Authority | Middle East |

Why are private equity returns higher?

Private equity firms encourage investment from wealthy sources by boasting greater return on investment (ROI) than other alternative asset classes or more conventional investment options.

What is the role of private equity firms?

The purpose of private equity firms is to provide the investors with profit, usually within 4-7 years. It comprises companies or investment managers that acquire capital from wealthy investors to invest in existing or new companies. It can also exit the investment via an initial public offering.

How do I get into private equity?

Candidates should have a bachelor’s degree in a major like finance, accounting, statistics, mathematics, or economics. Private equity firms do not usually hire straight out of college or business school unless the student has previous significant private equity internships or work experience.

Is private equity difficult?

It will be very difficult to get into private equity without experience in IB or PE and without having gone to a typical target school. However, it is not impossible to break into the industry.

How successful is private equity?

Which country has the largest investment fund?

China List of countries by sovereign wealth funds

| Rank | Country | Assets (USD Billion) |

|---|---|---|

| 1 | China | 2,244.4 |

| 2 | United Arab Emirates | 1,363.0 |

| 3 | Norway | 1,322.6 |

| 4 | Saudi Arabia | 899.9 |