Structured Settlement Protection Acts are laws in 49 states and the District of Columbia that exist to protect recipients of structured settlement payments from the predatory purchasing practices often associated with the sale of structured settlement payments.

What are structured settlement rights?

Structured settlements are periodic payments made to a plaintiff who wins or settles a personal injury lawsuit. Instead of receiving a lump sum of money for damages, the injured party can receive a series of payments made over time.

Can you break a structured settlement?

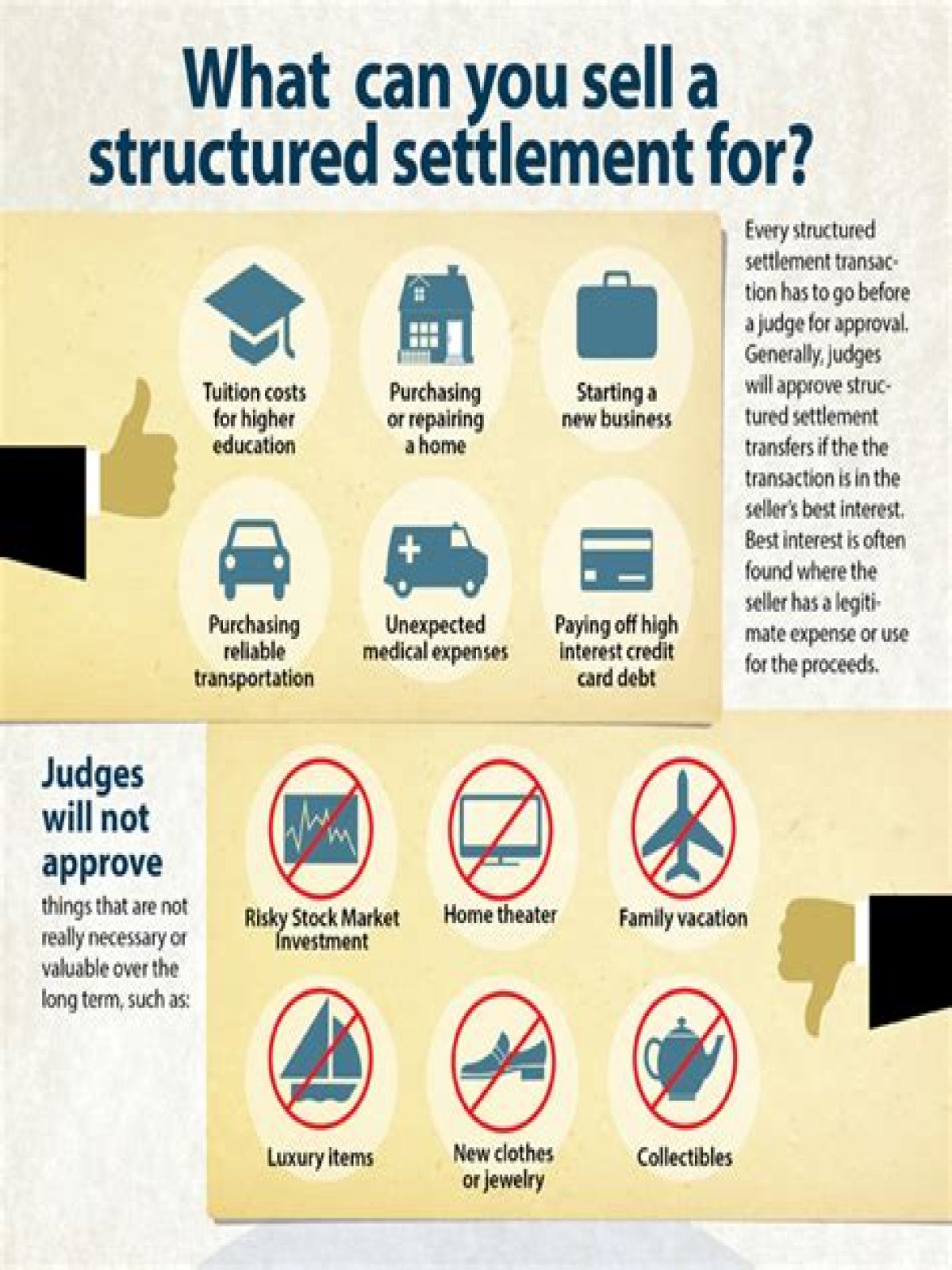

It is absolutely legal to sell a structured settlement for instant cash, although you’ll need to get court approval before proceeding. You’re not breaking any law by selling your structured settlement.

How are structured settlements paid out?

A structured settlement can include a large lump-sum payment upon termination of the contract. A child recipient may receive regular payments while they are a minor and then one large lump sum to pay for their college tuition when they graduate from high school.

What companies buy structured settlements?

Companies that Buy Structured Settlement

- AnnuityFreedom.net. (877) 547-3672.

- JG Wentworth. Website: jgwentworth.com.

- Annuity.org. Website: annuity.org.

- DRB Capital.org. Telephone: (888) 981-8703.

- Fairfield Funding. Telephone: 855-296-0985.

- Novation Settlement Solutions. Telephone: (888) 797-3740.

- RSL Funding.

- Seneca One.

Are Structured Settlements a good idea?

Structured settlements offer plaintiffs the certainty of payments over a fixed period of time. However, lump sum payments may be better suited for cases involving minors, as they allow for long-term investing, or those suffering from a debilitating injury that will require future medical expenses.

Why structured settlements are bad?

A major drawback of a structured settlement is that it may jeopardize the beneficiary’s eligibility for public benefits, which may be particularly problematic when the person’s medical needs are covered by Medicaid rather than private health insurance.

Is a structured settlement considered income?

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.