The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. A net lease is the opposite of a gross lease, where the tenant pays a flat rental fee while the landlord is responsible for the other costs.

What are the three types of net leases?

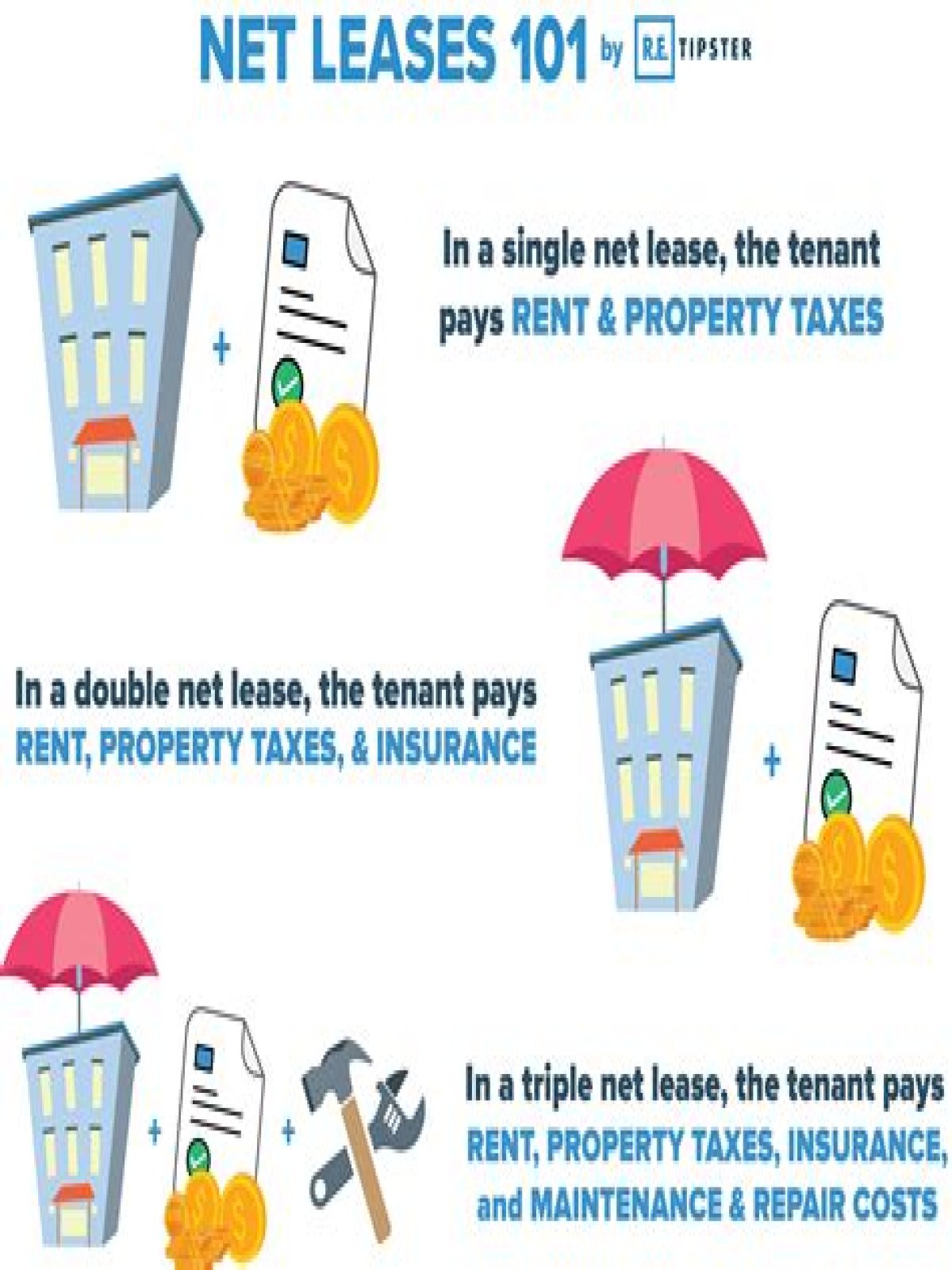

There are three main types of net leases: single net leases, double net leases, and triple net leases. When a tenant signs a single net lease, they pay one of the three expense categories: taxes, maintenance, and insurance fees.

What is a sandwich lease?

A sandwich lease is a lease agreement in which a party leases a property from an agent who is, in turn, leasing the property from the owner. A sandwich lease is a lease in which the lessor (landlord) of a property is also a lessee—leasing the property from the initial owner.

Who pays insurance on triple net lease?

If a property owner leases out a building to a business using a triple net lease, the tenant is responsible for paying the building’s property taxes, building insurance, and the cost of any maintenance or repairs the building may require for the term of the lease.

What is the most common lease for retail property?

And, how the most common retail leases are structured:

- Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes.

- Double net or NN lease. A double net or NN lease is similar.

- Triple net or NNN lease.

- Full-service gross or modified lease.

What is a reverse lease?

A “sale/leaseback” or “sale and leaseback” is a transaction in which the owner of a property sells an asset, typically real estate, and then leases it back from the buyer. In some arrangements, the current lessee will give the option to buy the asset back at the end of the lease.