The most common audit procedure involving the accounts receivable balance is confirmation. To test that accounts receivable exist, the auditor will send letters to a sample of the client’s customers asking to verify the amount that is owed to the company being audited.

How do you test the completeness of accounts receivable?

Here are some of the accounts receivable audit procedures that they may follow:

- Trace receivable report to general ledger.

- Calculate the receivable report total.

- Investigate reconciling items.

- Test invoices listed in receivable report.

- Match invoices to shipping log.

- Confirm accounts receivable.

- Review cash receipts.

What are the audit assertions for accounts receivable?

The primary relevant accounts receivable and revenue assertions are:

- Existence and occurrence.

- Completeness.

- Accuracy.

- Valuation.

- Cutoff.

What are the three types of substantive test?

The three types of substantive tests are analytical procedures, a test of details of transactions, and tests of details of balances.

What is the main purpose of substantive audit procedures?

The primary purpose of substantive analytical procedures is to obtain assurance, in combination with other audit testing (such as tests of controls and substantive tests of details), with respect to financial statement assertions for one or more audit areas.

What are the risks of accounts receivable?

Typical accounts receivable risks include:

- Overstatement of revenue: When revenue is overstated, more receivables are recorded than what customers actually owe.

- Unenforced cutoffs: Cutoffs ensure that financial transactions are accurate and accounted for in the correct accounting period.

Table of ContentsIs accounts receivable a high risk account?

Inherent Risk for Accounts Receivable The inherent risk in the case of accounts receivable is high. Auditors need to perform a test of control as well for accounts receivable to get a clearer picture of the inherent risk of accounts receivables.

What is a substantive test for cash?

Substantive Procedures for Cash Confirm cash balances. Vouch reconciling items to the subsequent month’s bank statement. Ask if all bank accounts are included on the general ledger. Inspect final deposits and disbursements for proper cutoff.

What are the different types of substantive procedures?

There are two categories of substantive procedures – analytical procedures and tests of detail. Analytical procedures generally provide less reliable evidence than the tests of detail.

What are the objectives of account receivable audit?

The overall objective of the audit of accounts receivable and sales is to determine if they are fairly presented in the context of the financial statements as a whole. The sales account is closely tied to accounts receivable; therefore, evidence supporting accounts receivable tends to support sales.

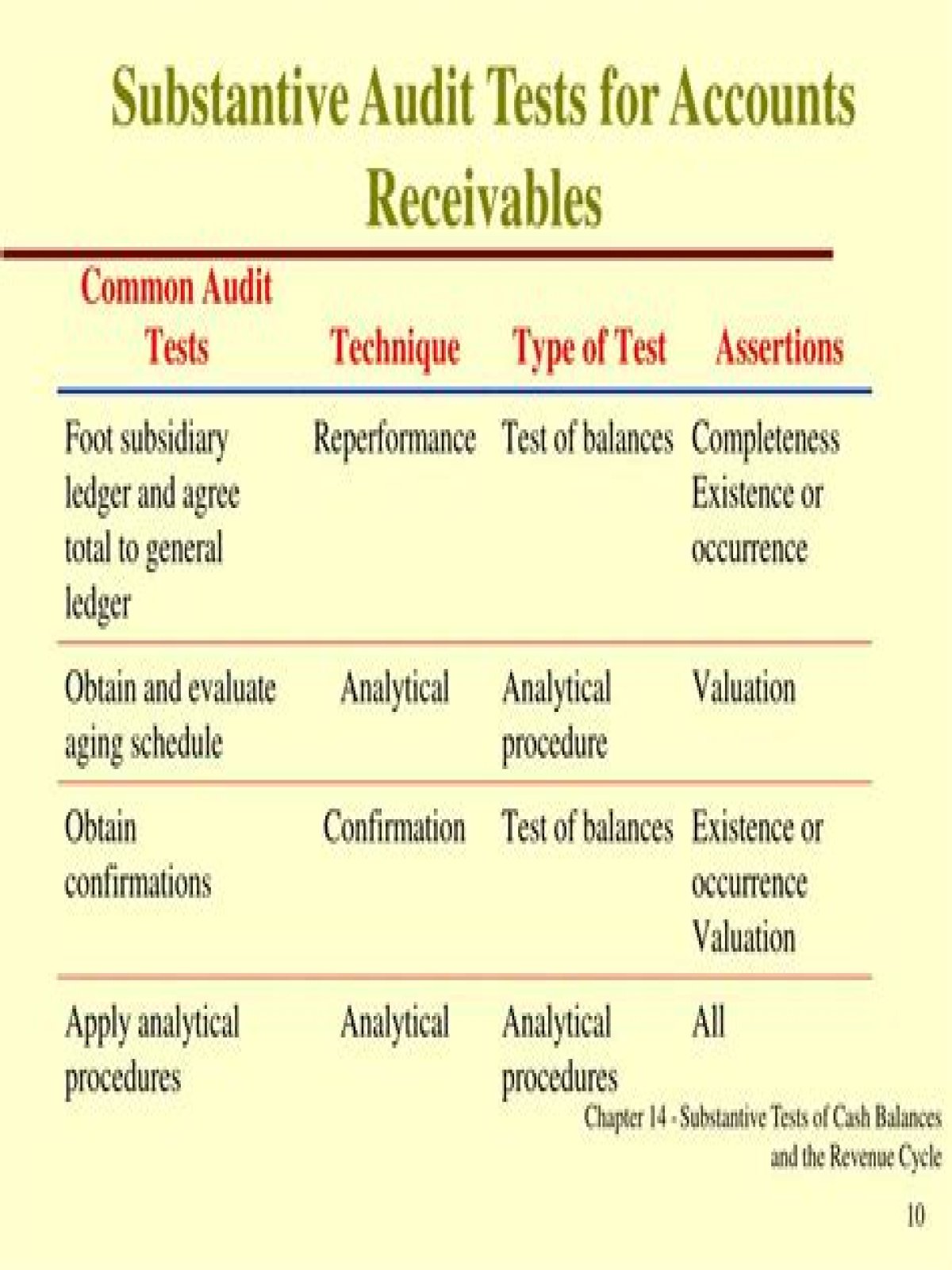

What are substantive audit procedures for accounts receivable?

Auditors use substantive audit procedures to test the balances of accounts receivable. Substantive audit procedures are direct tests using specific information from a company’s accounting system and financial statements. The first step in auditing a company’s accounts receivable process is to examine the original information.

How to study substantive tests of receivables flashcards?

Start studying Auditing 06: Substantive Tests of Receivables. Learn vocabulary, terms, and more with flashcards, games, and other study tools. HomeBrowse Create Search Log inSign up Upgrade to remove ads Only $2.99/month Auditing 06: Substantive Tests of Receivables STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Created by hana-takudo

How to audit sales and receivables Chapter 14?

1. Chapter 14 Auditing Sales and Receivables Prepared by Dr Phil Saj 1 2. Learning objectives 1. Identify the audit objectives applicable to sales and receivables. 2. Describe the functions and control procedures normally found in information systems for processing sales, cash receipts and sales adjustment transactions. 3.

When to use positive confirmation of accounts receivable?

9) The auditor should use positive confirmation of accounts receivable a) When internal controls over the receivables process are believed to be strong. b) When the possibility of disputes in the accounts is greater than usual. c) For individual account balances that are immaterial in amount.