Traditional IRA Contributions Are Deductible A traditional IRA is funded using pre-tax dollars. That means that once you start taking distributions, you’ll have to pay taxes on the money at your regular rate. The upside is that you can deduct the money you put in, which can reduce your taxable income for the year.

Can you contribute to IRA for previous years?

You get three extra days to file your taxes. Fortunately, however, you can make prior year IRA contributions up until the tax filing date. So if you meant to start an IRA last year but forgot, you can still open an account, fund it, and count the contributions for the prior tax year.

Can you still contribute to 2019 IRA?

Eligible taxpayers can usually contribute up to $6,000 to an IRA for 2019. The limit is increased to $7,000 for taxpayers who were age 50 or older by the end of 2019. Contributions to traditional IRAs are deductible up to the lesser of the contribution limit or 100% of the taxpayer’s compensation.

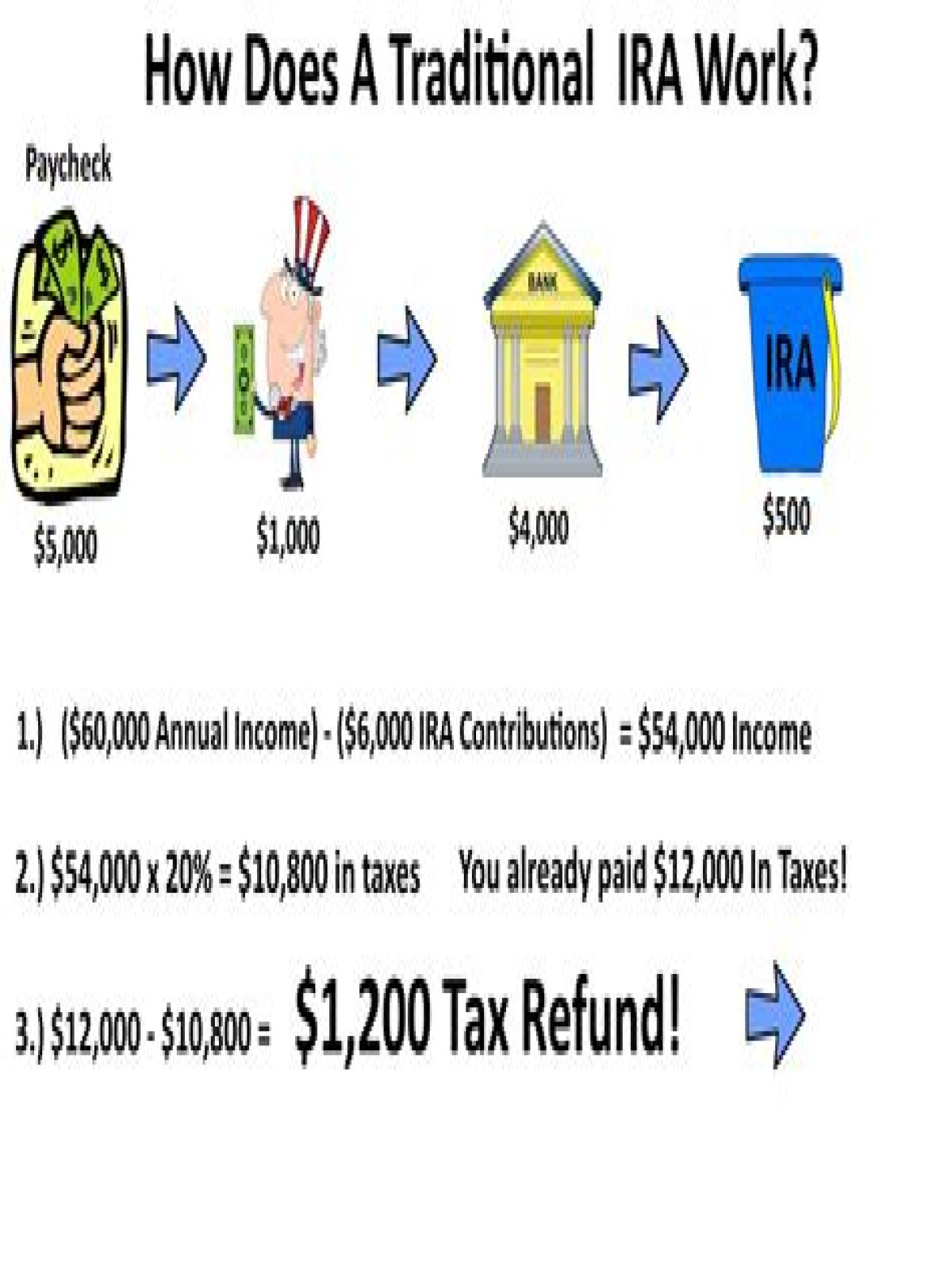

In the eyes of the IRS, your contribution to a traditional IRA reduces your taxable income by that amount and, thus, reduces the amount you owe in taxes.

Do I pay taxes on IRA transactions?

As long as the money stays in your IRA, there are no tax consequences; this applies to capital gains, dividend payments, and interest income.

How can I reduce my IRA taxes?

Contribute to an IRA. You can defer paying income tax on up to $6,000 that you deposit in an individual retirement account. A worker in the 24% tax bracket who maxes out this account will reduce his federal income tax bill by $1,440. Income tax won’t apply until the money is withdrawn from the account.

How can I pay tax on my IRA?

You can also use Mastercard (Credit or Debit cards) to pay tax on AXS e-Station over the internet or AXS m-Station mobile app. Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

Can you use a credit card to pay tax on an IRA?

You can also use Mastercard (Credit or Debit cards) to pay tax on AXS e-Station over the internet or AXS m-Station mobile app. Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers.

When do you pay taxes on an IRA withdrawal?

You are credited for the taxes paid during the year no matter when the withdrawal and withholding is done. This is similar to taxes withheld during the year, as reported on an employee’s Form W‑2. IRA withdrawals are reported on IRS Form 1099‑R, along with the amount of tax withheld.

Do you have to pay taxes on contributions to traditional IRA?

Contributions you make to a traditional IRA may be fully or partially deductible, depending on your circumstances, and Generally, amounts in your traditional IRA (including earnings and gains) are not taxed until distributed.