The return of a corporation with respect to income shall be signed by the president, vice-president, treasurer, assistant treasurer, chief accounting officer or any other officer duly authorized so to act.

Can a Corporate Controller sign a tax return?

Any corporate officer can sign, provided the corporation authorizes him to do so. The individual must be a corporate officer, such as a tax officer. An individual who is not an officer, such as a non-officer tax director, is not eligible to sign the return.

Who is allowed to sign a tax return?

You may be authorized to sign either as the taxpayer’s representative or agent. Generally, a representative must be an individual eligible to practice before the IRS, such as an enrolled agent, attorney, or CPA; a family member (limited to spouse, parent, child, brother, or sister) may also act as your representative.

Can a manager of an LLC sign a tax return?

Neither the Internal Revenue Code (Code) nor Treasury Regulations deal with signatures by LLC members, however, the instructions for both the Form 1065 and IRS Publication 3402, Taxation of Limited Liability Companies, (March 2010) state that “only a member manager of an LLC can sign the partnership tax return. …

Can a limited partner sign a tax return?

United States: IRS Reiterates Who May Sign Partnership Return. Section 6063 states that a partnership return must be signed by any one of the partners and that a partner’s signature is prima facie evidence that the partner is authorized to sign the return on behalf of the partnership.

Who must sign a form 1065?

14113: 1065 – Who Must Sign Form 1065 is not considered to be a return unless it is signed by a general partner or LLC member manager. When a return is made for a partnership by a receiver, trustee, or assignee, the fiduciary must sign the return, instead of the general partner or LLC member manager.

Can a partnership representative sign tax returns?

A partnership must designate a partnership representative on its tax return for each taxable year unless it makes a valid election out of the centralized partnership audit regime. The partnership representative must have a substantial presence in the United States.

What tax return does an LP file?

The general partner files a Form 1065, U.S. Return of Partnership Income with the IRS, an informational return listing the profits or losses for the year and any distributions sent to the limited partners.

How are Mlps taxed when sold?

When you sell an MLP, you will calculate your gain or loss, just as you would with any other investment. Your taxable gain is the difference between the sales price and your adjusted tax basis. First, the portion of your gain that is attributable to depreciation is taxed at ordinary income rates (called “recapture”).

Who should sign a minor tax return?

Advise the taxpayer they’re responsible for the information on the return. If a child can’t sign his or her name, the parent, guardian, or another legally responsible person must sign the child’s name in the space provided followed by the words “By (parent or guardian signature), parent or guardian for minor child.”

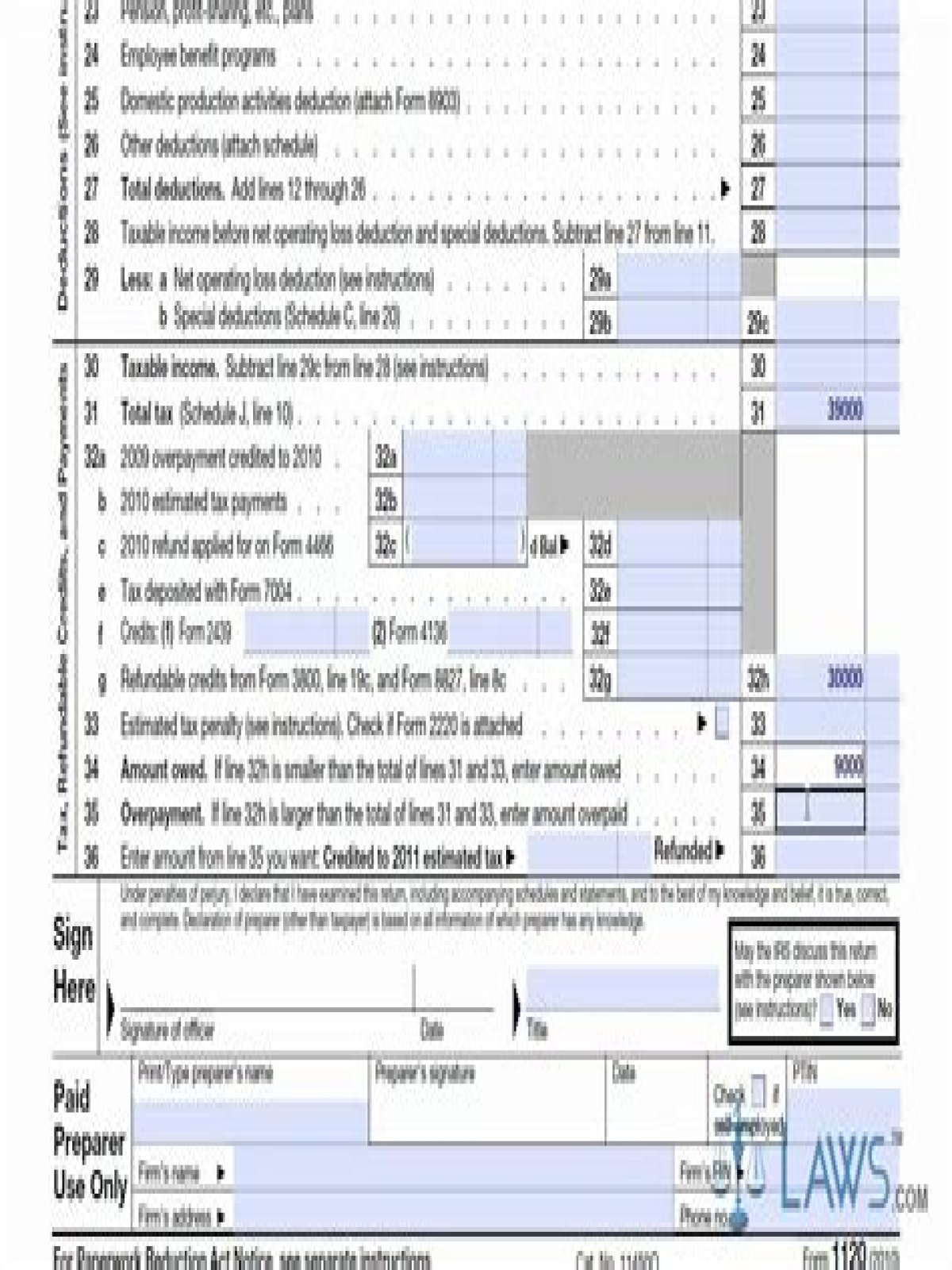

The CCA relies upon Section 6062, which provides that corporate returns must be signed by the “president, vice-president, treasurer, assistant treasurer, chief accounting officer or any other officer duly authorized.” This is repeated in the Form 1120 instructions under “Who Must Sign,” where it says “the president.

Can a corporate Controller sign a tax return?

Do tax returns need to be signed?

You must sign and date IRS Form 8878 or IRS Form 8879 after reviewing the return and ensuring that the tax return information on the form matches the information on the return. Electronic signatures appear in many forms and may be created by many different technologies.

Who can sign off on tax returns?

What happens if you dont sign your tax return?

If you submitted your return without signing it, all is not lost. In all likelihood, the IRS will simply send you a letter requesting your signature. And once they receive your signature, they’ll go ahead and process your return. If you choose not to do this, then you will have to complete and sign IRS Form 8453.

Do I need to sign my tax return if I efile?

When you file your individual tax return electronically, you must electronically sign the tax return with a personal identification number (PIN) using the Self-Select PIN or the Practitioner PIN method.

Can you electronically sign a tax return?

How does the e-signature option work? Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

When to file tax return for S Corp?

In the first year of operation, the S corp files the Form 1120S and indicates that it will serve as the company’s initial return. When a company contracts with someone to complete a task or provide a service, the company files a Form 1099 to tell the IRS that the provider received income.

Can a representative of a corporation sign a tax return?

A representative of a U.S. corporation cannot sign its return under a power of attorney. Regs. Sec. 1.6012-1 (a) (5) provides that an individual’s tax return may be signed by an agent under certain specific circumstances. Regs. Sec. 1.6012-2, which deals with corporate returns, does not contain similar provisions.

How to file income tax and corporate income tax return?

The following are of importance when filing mandatory digital income tax and corporate income tax returns: In addition to your tax return letter, you also receive an e-mail notification if you have issued an e-mail address. This is to inform you that the tax return form is ready for you in the secured section of the Internet site.

How to file company tax return with HMRC?

Use this service to file your company or association’s: Company Tax Return (CT600) for Corporation Tax with HM Revenue and Customs (HMRC) accounts to Companies House Company Tax Return and accounts at the same time if they’re for the same accounting period