In this situation, the CG2010 (or its equivalent) would be required to insure for ongoing operations PLUS the CG2037 (or its equivalent) would be required to insure for completed operations once the work was completed.

What is a CG 2037 endorsement?

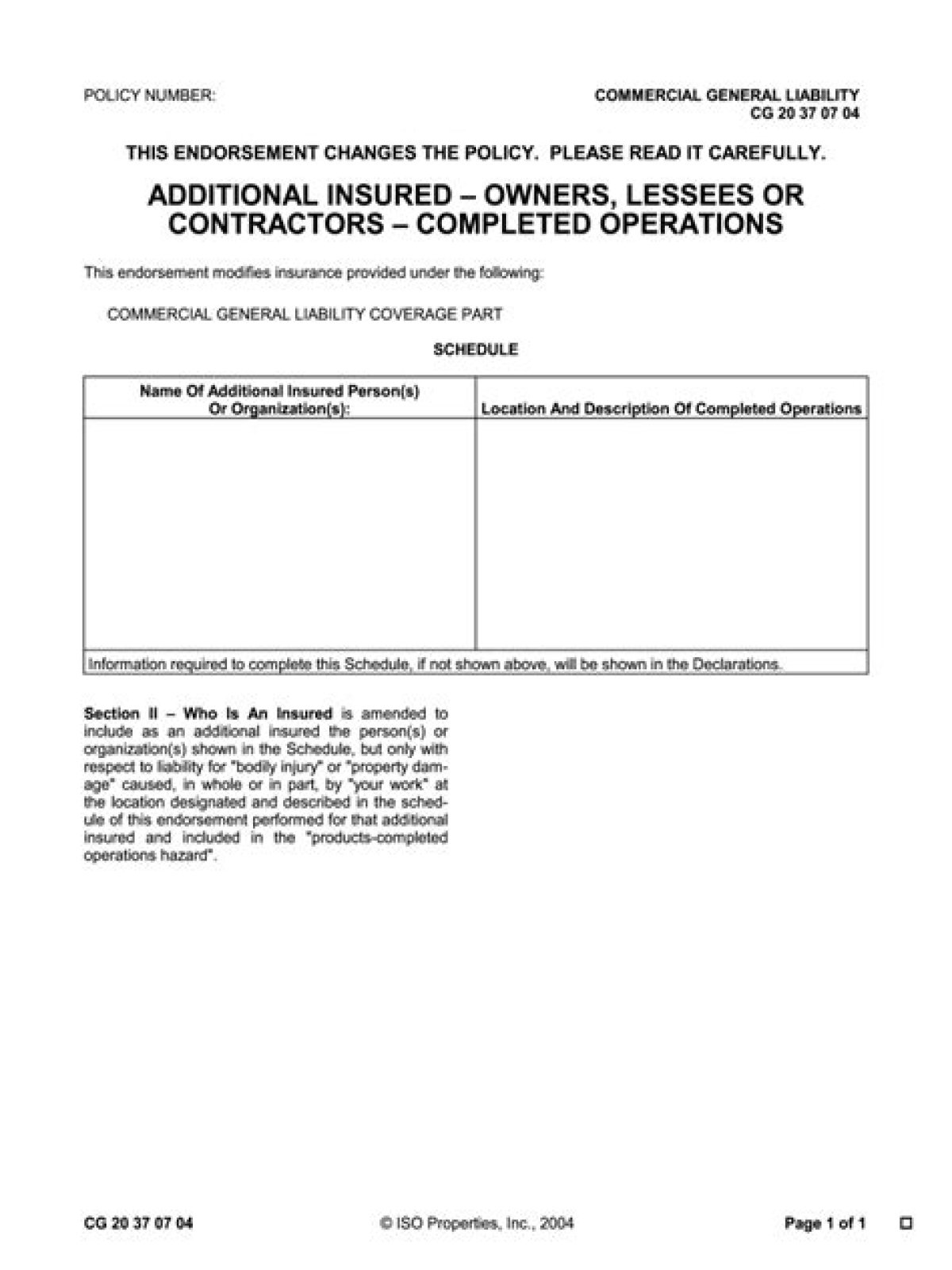

The CG 20 37 – Additional Insured – Owners, Lessees or Contractors – Completed Operations has been specifically written to provide coverage to the additional insured for certain bodily injury or property damage claims that occur after the project is finished.

What is CG2033?

CG2033 4/13 This additional insured endorsement is a blanket additional insured endorsement and has the following limitations and conditions: The additional insured (e.g. project owner, general contractor) is not insured for their sole negligence.

What is a CG 2038?

The ISO “Additional Insured—Owners, Lessees or Contractors—Automatic Status for Other Parties When Required in Written Construction Agreement with You” endorsement (CG 20 33) has been found in some instances to include as additional insured only those parties with which the downstream party entered a direct contract or …

What is a CG 20 37?

Scheduled Endorsements A scheduled endorsement contains a “schedule” in which the person or organization that is named in the schedule is added to the policy as an additional insured. Alternatively, the general contractor can be named as an additional insured for completed operations via a CG 20 37 07 04 endorsement.

What is a cg2037 and when is it needed?

The CG2037 – Additional Insured – Owners, Lessees or Contractors – Completed Operations has been specifically written to provide coverage to the additional insured for certain bodily injury or property damage claims that occur after the project is finished . Extended Completed Operations Coverage. While a general contractor surely has its own liability insurance program (sometimes called its “practice insurance program”), they can also purchase a separate project specific liability

What is a blanket additional insured endorsement?

What is ‘Blanket Additional Insured Endorsement’. A blanket additional insured endorsement is an insurance policy endorsement that automatically provides coverage to any party to which the named insured is contractually required to provide coverage.

What do you need to know about Additional Insured Endorsements?

The additional insured (e.g.

What are Additional Insured Endorsements?

Additional insured coverage is typically provided via an endorsement. Some endorsements are very specific. They cover the person or company listed in the endorsement only. Others provide blanket coverage. They cover anyone who meets the definition of additional insured in the endorsement.