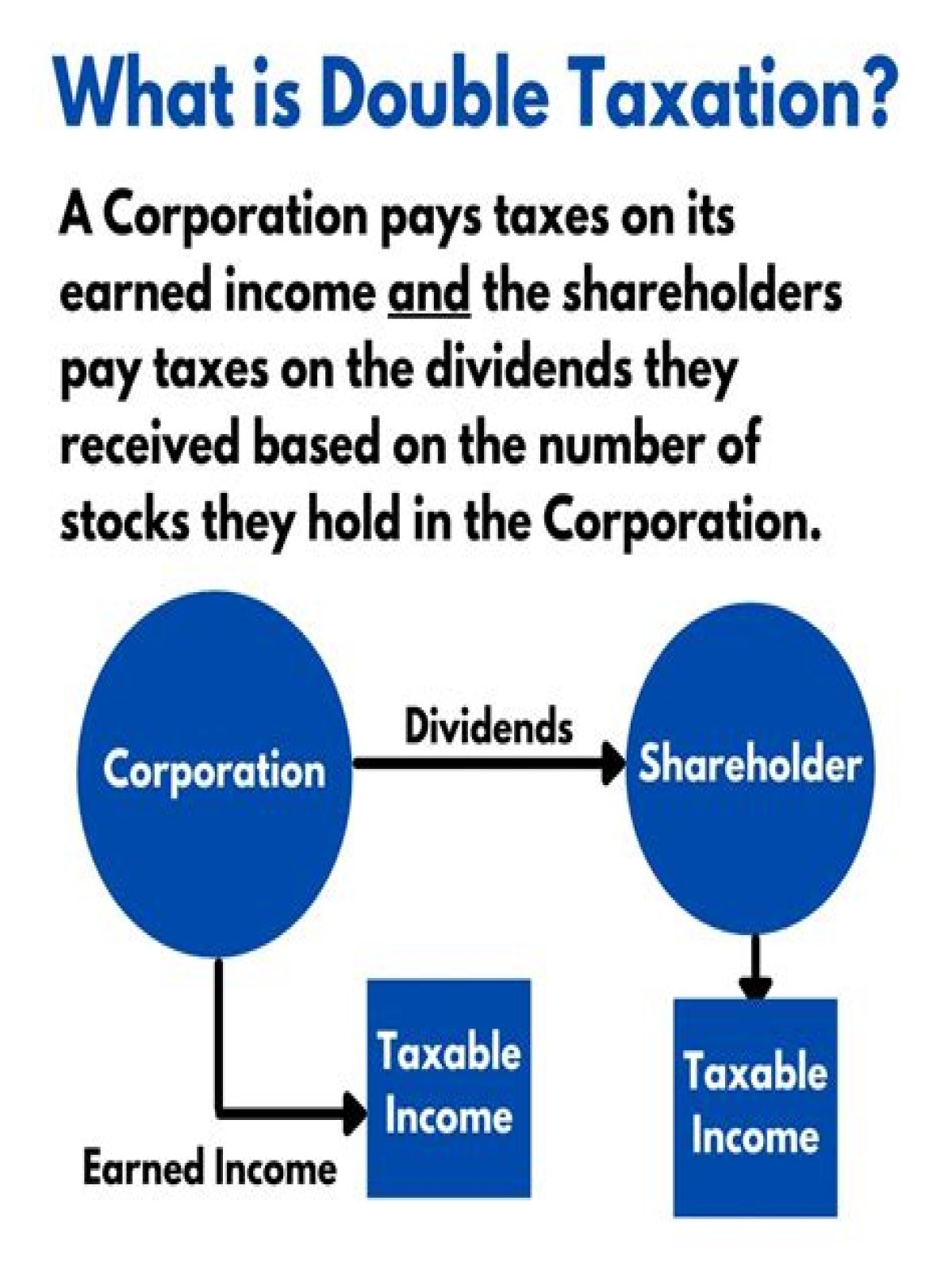

Double taxation refers to income tax being paid twice on the same source of income. Double taxation occurs when income is taxed at both the corporate level and personal level, as in the case of stock dividends. Double taxation also refers to the same income being taxed by two different countries.

Does double taxation apply to corporations?

It appears that the same income is taxed twice, once in the corporation and then again personally in your hands when funds are withdrawn as a dividend.

Which corporation uses a double layer of taxation?

C-corp Double taxation occurs when a C-corp generates a profit for the year AND distributes that profit to shareholders in the form of a dividend. It’s called double taxation because the profits are taxed first at the corporate level and again by the recipient of dividends at the individual level.

Why do corporations have double taxation?

Double taxation often occurs when corporate earnings are taxed at both the corporate level and again at the level of shareholder dividends. In the United States, this type of taxation is widespread, because the tax on corporate profits and the personal dividend income tax are federal and thus universal taxes.

- Does double taxation apply to corporations?

- What are the elements of double taxation?

- What are the disadvantages of double taxation?

- How do corporations avoid double taxation?

- How can a corporation avoid double taxation?

- How does double taxation of a corporate income occur?

- Do sole proprietors have double taxation?

What are the elements of double taxation?

There is double taxation when the same taxpayer is taxed twice when he should be taxed only once for the same purpose by the same taxing authority within the same jurisdiction during the same taxing period, and the taxes are of the same kind or character.

What are the disadvantages of double taxation?

The disadvantages of a corporation are as follows: Double taxation. Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice. Excessive tax filings.

What 3 business types are subject to double taxation?

What is double taxation?

- Sole proprietorships.

- Partnerships.

- Limited liability companies (LLC)

- S corporations.

Who introduced double taxation?

Double Taxation Avoidance Agreement (DTAA) is an agreement between two countries that the income of non-residents should not be taxed both in their country of origin and in the country in which they live. Model forms were first prepared by the Fiscal Committee of the League of Nations in 1927.

How do corporations avoid double taxation?

You can avoid double taxation by keeping profits in the business rather than distributing it to shareholders as dividends. If shareholders don’t receive dividends, they’re not taxed on them, so the profits are only taxed at the corporate rate.

How can a corporation avoid double taxation?

How to avoid double taxation for small corporations?

Don’t structure your business as a C corporation Because C corporations are considered separate legal entities,they offer many advantages to businesses.

How do large corporations avoid taxes?

Foreign Subsidiaries. Although the corporate tax rate has been reduced,companies are still using tax loopholes to save money.

How does double taxation of a corporate income occur?

Passed Along Profits are Considered Income by the IRS. When a C-corporation passes along the profits to its shareholders,the IRS recognizes that money as income.

Do sole proprietors have double taxation?

Double Taxation. When the corporation issues dividends to shareholders, those dividends are taxed on a shareholder’s individual tax return. Sole proprietorships don’t file taxes on the business level. Rather, sole proprietors claim business profits and losses on an individual or joint tax return.