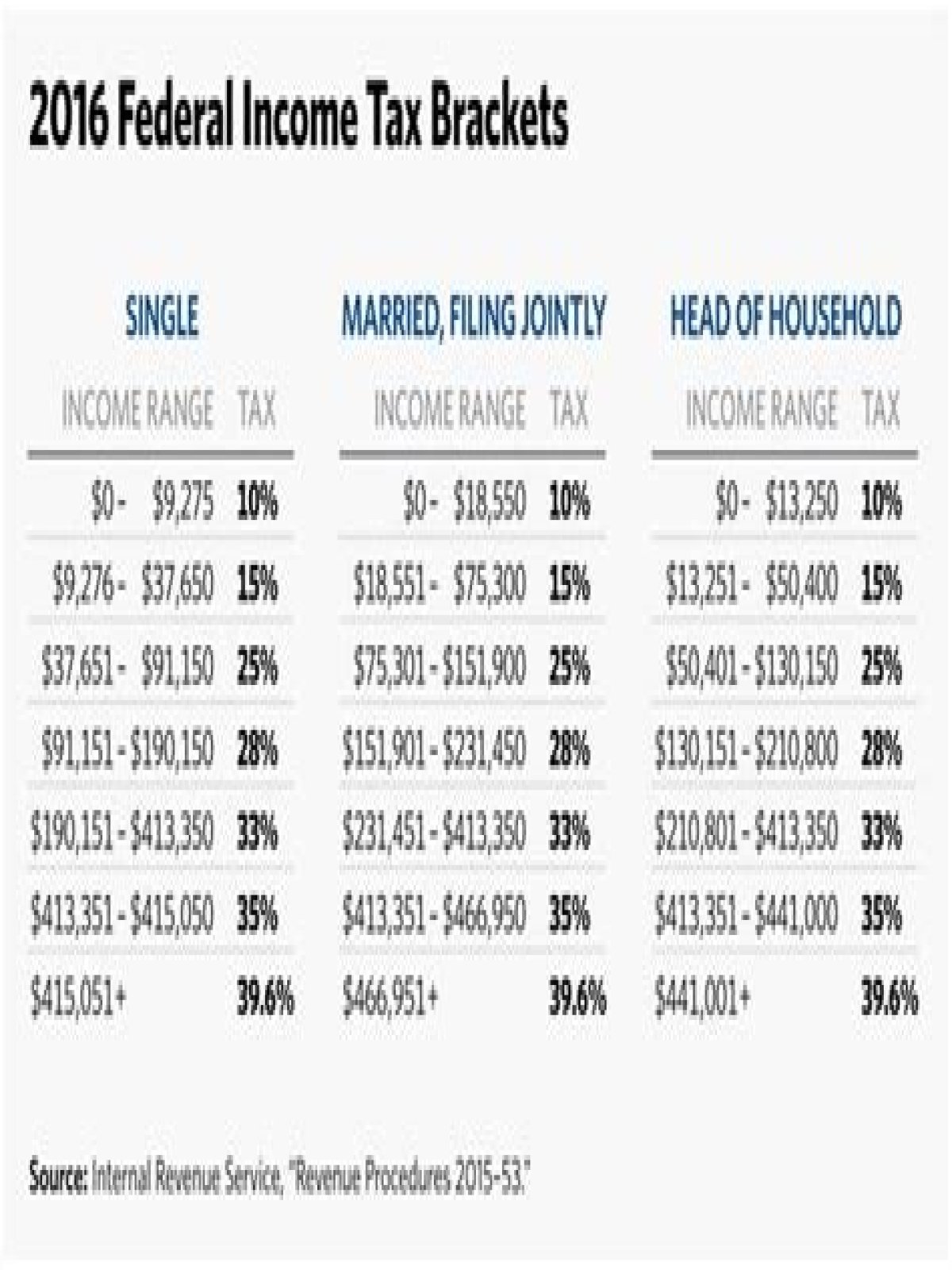

Taxpayers fall into one of seven 2016 tax brackets, depending on their taxable income: 10%, 15%, 25%, 28%, 33%, 35% or 39.6%….How We Make Money.

| Tax rate | Single | Head of household |

|---|---|---|

| 10% | $0 to $18,550 | $0 to $9,275 |

| 15% | $18,551 to $75,300 | $9,276 to $37,650 |

| 25% | $75,301 to $151,900 | $37,651 to $75,950 |

What was the tax bracket in 2017?

What Are the Trump Tax Brackets?

| 2017 Federal Income Tax Brackets (Pre-Trump Tax Laws) | ||

|---|---|---|

| Tax Rate | Single | Married Filing Separately |

| 10% | $0 – $9,325 | $0 – $9,325 |

| 15% | $9,326 – $37,950 | $9,326 – $37,950 |

| 25% | $37,951 – $91,900 | $37,951 – $76,550 |

What are the tax rate for the assessment year 2017 18?

| INCOME SLABS | INCOME TAX RATES |

|---|---|

| Upto Rs.2,50,000 | NIL |

| Rs. 2,50,000 to 5,00,000 | 10% of the amount exceeding Rs. 2,50,000 Less: Tax Credit – 100% of income-tax or Rs. 5,000/-, whichever is less *. |

| Rs. 5,00,000 to 10,00,000 | Rs. 25,000 + 20% of the amount exceeding Rs. 5,00,000 |

What is the income tax slab for FY 2017-18?

Income Tax Slab Rate For Men below 60 Years of Age

| Income Tax Slab | Income Tax For FY 2017-18 |

|---|---|

| Income between Rs. 2,50,001 – Rs. 500,000 | 5% of Income exceeding Rs. 2,50,000 |

| Income between Rs. 500,001 – Rs. 10,00,000 | 20% of Income exceeding Rs. 5,00,000 |

| Income above Rs. 10,00,000 | 30% of Income exceeding Rs. 10,00,000 |

What are the 2018 tax brackets VS 2017?

2017 vs. 2018 Federal Income Tax Brackets

| Single Taxpayers | ||

|---|---|---|

| 2018 Tax Rates – Standard Deduction $12,000 | 2017 Tax Rates – Standard Deduction $6,350 | |

| 10% | 0 to $9,525 | 10% |

| 12% | $9,525 to $38,700 | 15% |

| 22% | $38,700 to $82,500 | 25% |

What was tax rate in 2018?

2018 tax brackets

| Federal tax brackets and rates for 2018 | ||

|---|---|---|

| Tax rate | Single | Married filing jointly |

| 12% | $9,526–$38,700 | $19,051–$77,400 |

| 22% | $38,701–$82,500 | $77,401–$165,000 |

| 24% | $82,501–$157,500 | $165,001–$315,000 |

What is the tax rate in India?

Income Tax Slabs & Rates 2020-2021

| Income Tax Slab | Tax rates as per new regime |

|---|---|

| ₹0 – ₹2,50,000 | Nil |

| ₹2,50,001 – ₹ 5,00,000 | 5% |

| ₹5,00,001 – ₹ 7,50,000 | ₹12500 + 10% of total income exceeding ₹5,00,000 |

| ₹7,50,001 – ₹ 10,00,000 | ₹37500 + 15% of total income exceeding ₹7,50,000 |

Is standard deduction part of 80C?

A standard deduction of ₹ 50,000 is available for all salaried individuals under the Income Tax Act, 1961. Income tax deduction limit under section 80C is set to ₹ 1.50 Lakh.

What is the tax rate for a company in India 2017-18?

However, for Assessment year 2017-18, tax rate is 29% if turnover or gross receipt of the company does not exceed Rs. 5 crore.

What is the rate of corporate tax for 2016-17?

Corporation Tax Rate for Financial year 2016-17 In case of domestic company, the rate of corporate tax shall be 29% of the taxable profit if the total turnover or gross receipts of the company in the previous year 2014-15 does not exceed Rs. 5 crore and in all other cases the rate of Income tax shall be 30% of the taxable profit.

What are the changes in income tax slab rates in 2016-17?

No changes have been made to the existing income tax slab rates for Financial year 2016-17 in the recent Budget announced by our Honorable Finance Minister. However, there has been changes in surcharge, marginal relief and rebate of income tax. Thus, it becomes important to discuss the overall impact of the tax rates.

What is the tax rate of local authority in India?

For the Assessment Year 2016-17 and 2017-18, a local authority is taxable at 30%. Add: d) Surcharge: The amount of income-tax shall be increased by a surcharge at the rate of 12% of such tax, where total income exceeds one crore rupees.