Whatever the value of their homes, manufactured housing residents who live in mobile home parks pay a flat fee (called a ‘specific tax’) of $36 a year in lieu of property taxes, and when they purchase their homes they pay sales tax.

Are mortgage rates higher for manufactured homes?

The loans work almost exactly the same as financing for traditional “stick-built” houses. With Fannie and Freddie loans, you can put as little as 5 percent down. There are extra risk-based loan fees for manufactured housing, so rates are slightly higher.

Can you negotiate the price of a manufactured home?

Sales Negotiations Don’t be scared to negotiate the price of a manufactured home. Manufactured home dealerships mark up the price of each home an average of 18 to 26 percent. Even if you buy a home at invoice dealers will still make a profit based on the holdback.

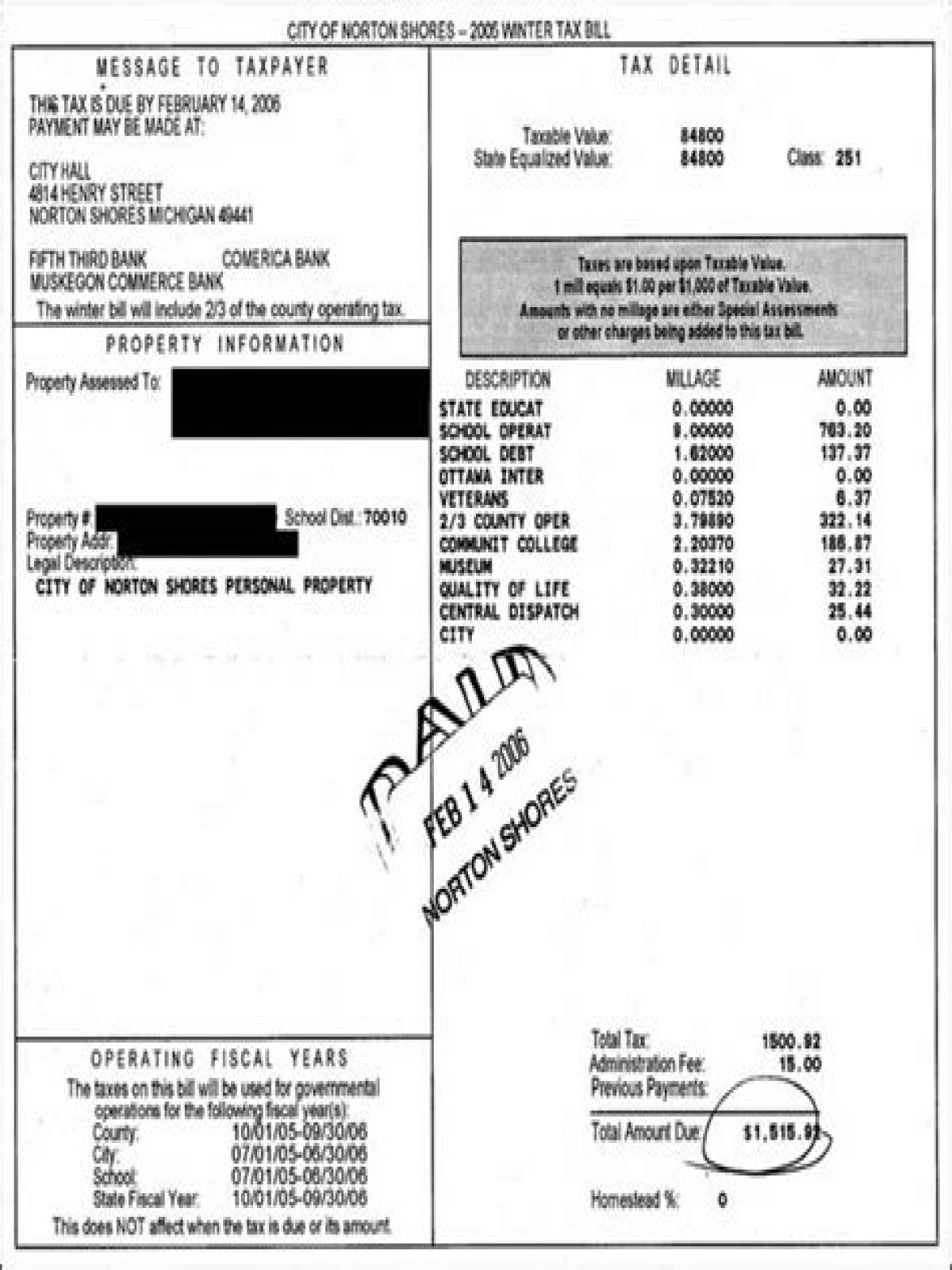

Do you have to pay property taxes on a mobile home in Michigan?

Property taxes for a mobile home must be paid by the owner of the home. However, some states, such as Michigan, require no annual tax for factory-built homes. Often, in lieu of annual taxes, the state will levy a tax at the time of the manufactured or mobile home purchase.

Are sheds taxable in Michigan?

The State of Michigan requires the Township to assess personal property taxes on items that you own near or adjacent to your mobile home, such as awnings, porches, decks, carports or sheds. This only applies to homes in mobile home parks; residential homes are assessed for these items as real property.

What credit score do you need to buy a manufactured home?

VA loans for manufactured homes

| Manufactured Home Loans | ||

|---|---|---|

| Down payment minimum | 3% | 5% |

| Loan type | Fixed-rate and adjustable-rate | Fixed-rate and adjustable-rate |

| Maximum loan amount | Based on lender requirements | Varies by lender requirements |

| Minimum credit score | 620 | 620 |

What is the best brand of manufactured home?

Best Mobile Home Manufacturers

- Best Overall: Champion Home Builders.

- Best for Energy Efficiency: Clayton Homes.

- Best for Families: Fleetwood Homes.

- Best for Tiny Homes: Skyline.

- Best Custom: Adventure Homes.

- Best for First-Time Home Buyers: TRU Homes.

- Best for Modular Homes: Deer Valley.

Are manufactured homes worth the money?

Manufactured homes appreciate in value the same way conventional homes do. That is good news for millennial home buyers. Since building equity is one of the most important parts of home ownership, opting for an affordable manufactured home that appreciates in value over time is a great way to build wealth.

How can I tell the difference between a modular home and a manufactured home?

The main difference between manufactured and modular homes is that manufactured homes are built to the national HUD code, while modular homes are built to all applicable state and local building codes. This is similar to the way traditional site-built homes are constructed.

Can you deduct lot rent on taxes?

Can I Claim Mobile Home Lot Rent on My Taxes? Yes, lot rent on a mobile home is tax deductible – your monthly payments can be submitted on your state income tax return. However, most states view mobile home lot rent as a form of property tax payment that can be reimbursed.

What is considered personal property in Michigan?

In Michigan, the sale, use, storage or consumption of tangible personal property is subject to sales and use tax. [1] Tangible personal property is defined as personal property that can be seen, weighed, measured, felt or touched.

What credit score is needed to buy a manufactured home?

Your credit score, down payment amount and type of home and whether you’re buying the land will affect the amount you pay. To qualify for low mobile home interest rates, make sure your credit score is at least 700. You’ll need a score of 750 or higher to qualify for the best rates available.

Is it worth buying a manufactured home?

Is it easier to get approved for a manufactured home?

In fact, it can be much easier to get financing for a manufactured home than for a traditional frame or block house. Financing terms depend on the lender, but the minimum credit scores for the options we discuss below range from 580-650. Scores higher than 650 may get slightly better terms.