The process of converting foreign currency liability of the importer into Indian Rupee liability is called the crystallization of import LC bills. LC Bills under Usance terms are the bills payable by the buyer/importer at a specified period ‘after date’ or ‘after sight ‘of the bill.

What is export bill and import bill?

Import and Export Bills Banks facilitates documents movement and payments to suppliers. An export bill for collection is a way of trade finance whereby an exporter approaches bank to control document movement and release them.

What is import bill retirement?

Exchange control Copy of the Import Licence, if applicable. On receipt of the copy of lodgment voucher from the bank, the importer will deposit the required amount and take delivery the Shipping Documents. This stage is known as Retirement of Import Bills. #

What is export bill under LC?

The bank provides collection service or purchase / discount Export Bills under L/C to allow exporters to use the money before actually receiving payment or before the payment due date from a overseas buyer.

What is bill of discount?

What Is Bill Discounting? Bill Discounting is a trade-related activity in which a company’s unpaid invoices which are due to be paid at a future date are sold to a financier (a bank or another financial institution). This process is also called “Invoice Discounting”.

What is retirement of L C?

On receipt of the copy of lodgment voucher from the bank, the importer will deposit the required amount and take delivery the Shipping Documents. This stage is known as Retirement of Import Bills. Ø Particulars of Margin Voucher to be entered into L/C Liability and Margin Ledger (FEX-B-3).

What are the types of commercial bills?

Commercial Bills may be of the following types. Demand and usance bills….Accommodation and Supply Bills.

- Demand Bills and Usance Bills. A demand bill is one in which no time of payment is specified.

- Clean bills and documentary bills.

- Inland bills and foreign bills.

- Indigenous bills.

- Accommodation bills and supply bills.

What is a bill of export?

Shipping Bill/ Bill of Export is the main document required by the Customs Authority for allowing shipment. A shipping bill is issued by the shipping agent and represents some kind of certificate for all parties, included ship’s owner, seller, buyer and some other parties.

What is a sight bill?

At sight is a payment due on demand where the party receiving the good or service is required to pay a certain sum immediately upon being presented with the bill of exchange. This type of payment is also known as a “sight draft” or a “sight bill.”

What is bill Sell rate?

The bills selling rate is calculated by adding exchange margin to the TT selling rate. That means the exchange margin enters into the bills selling rate twice, once on the interbank rate and again on the TT selling rate.

What is import explain?

An import is a good or service bought in one country that was produced in another. Imports and exports are the components of international trade. If the value of a country’s imports exceeds the value of its exports, the country has a negative balance of trade, also known as a trade deficit.

WhAt is bill purchase in banking?

BILLS PURCHASED, in trade finance, allows a seller to obtain financing and receive immediate funds in exchange for a sales document not drawn under a letter of credit. The bank will send the sales documents to the buyers bank on behalf of the seller.

In simple terms, export bill collection means sending of export bills to overseas buyer through his bank to collect payment under export bills. Once after preparing such export documents, the exporter submits them with his authorized bank to send to his overseas buyer.

What is Bill crystallisation?

However, if export bills are not realized even after 30 days of its maturity, bank withdraws the facility of low interest rate by delinking the bills by converting commercial rate of interest. This is called crystallization of export bills. Crystallization of bills is also called delinking of export bills.

What is Bill of discount?

What is retirement of documents?

Retirement of Import Documents. (a) Loading of Goods and Receipt of Shipment Advice: On loading of goods the overseas supplier despatches the shipment advice to the importer informing him about the shipment of goods.

What does it mean to collect an import bill?

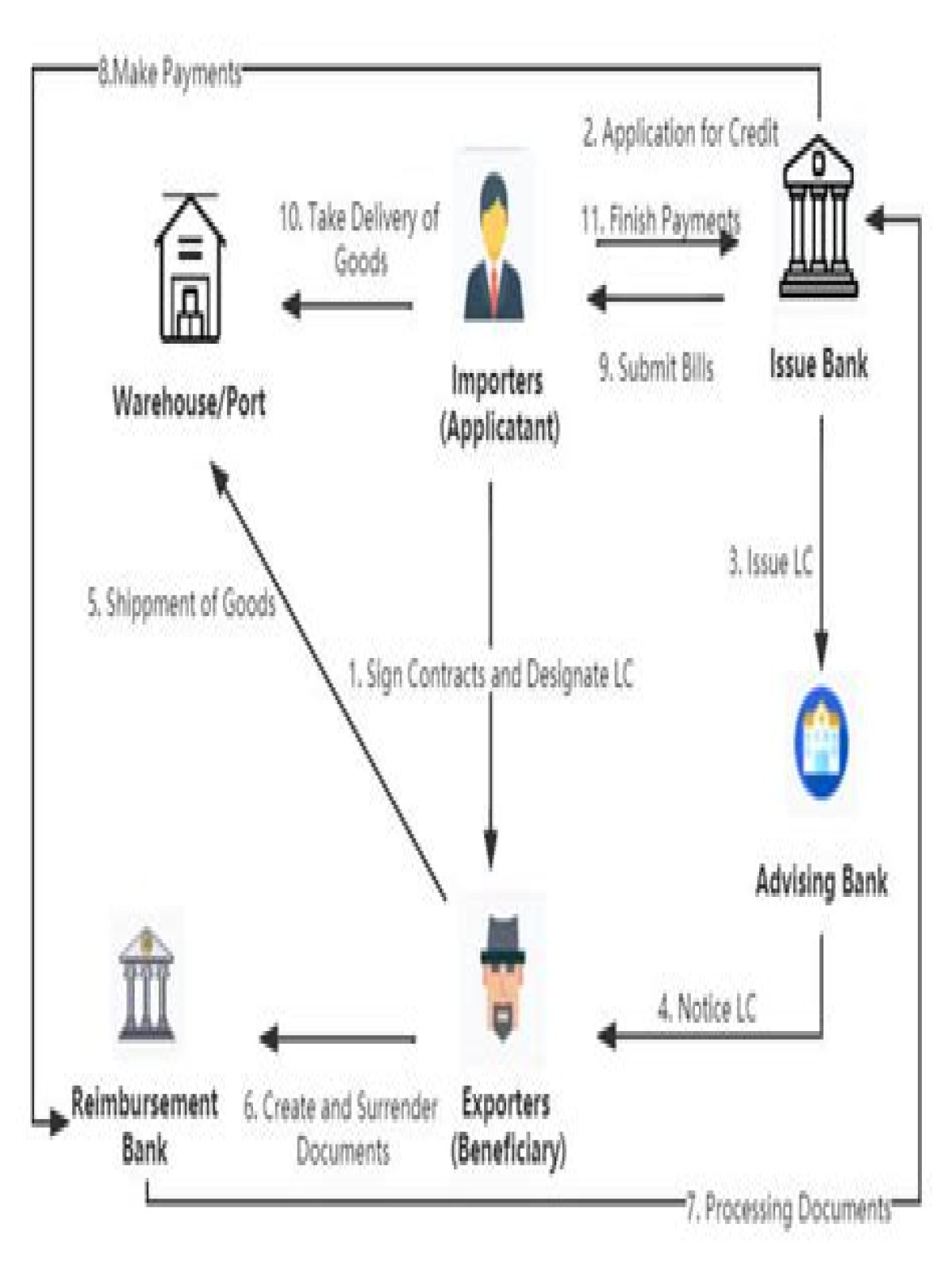

Facilitating Documentary collections and Payments for your imports. Import Bill Collection is a mode of payment for international trade where the seller forwards financial and/or commercial documents to the buyer, against which the payment is made.

How to collect import bill from ICICI Bank?

Import Bill for Collection services can be availed as follows: For Documents Against Acceptance (DA), ICICI Bank releases the import documents to the buyer on acceptance of the bills of exchange/draft. For Documents against Payment (DP), ICICI Bank release the import documents to the buyer once he has paid. ICICI Bank’s Import Bill for Collection.

How does import bill for collection ( Da / DP ) work?

For Documents against Payment (DP), ICICI Bank release the import documents to the buyer once he has paid. How does Import Bill for Collection (DA/DP) work? What more, you can avail a combination of three services Import Bill of Collection, Buyers Credit and Forwards with one-time documentation by using our three-in-one product ‘Import Plus’

What’s the difference between export Bill and export Bill?

Bank after verifying and confirming on such export documents, credits amount of invoice under the said shipment to his account. Once after receiving amount from overseas buyer , the bank adjust the said amount against the discounted amount after charging necessary bank interest till the date of export proceeds.