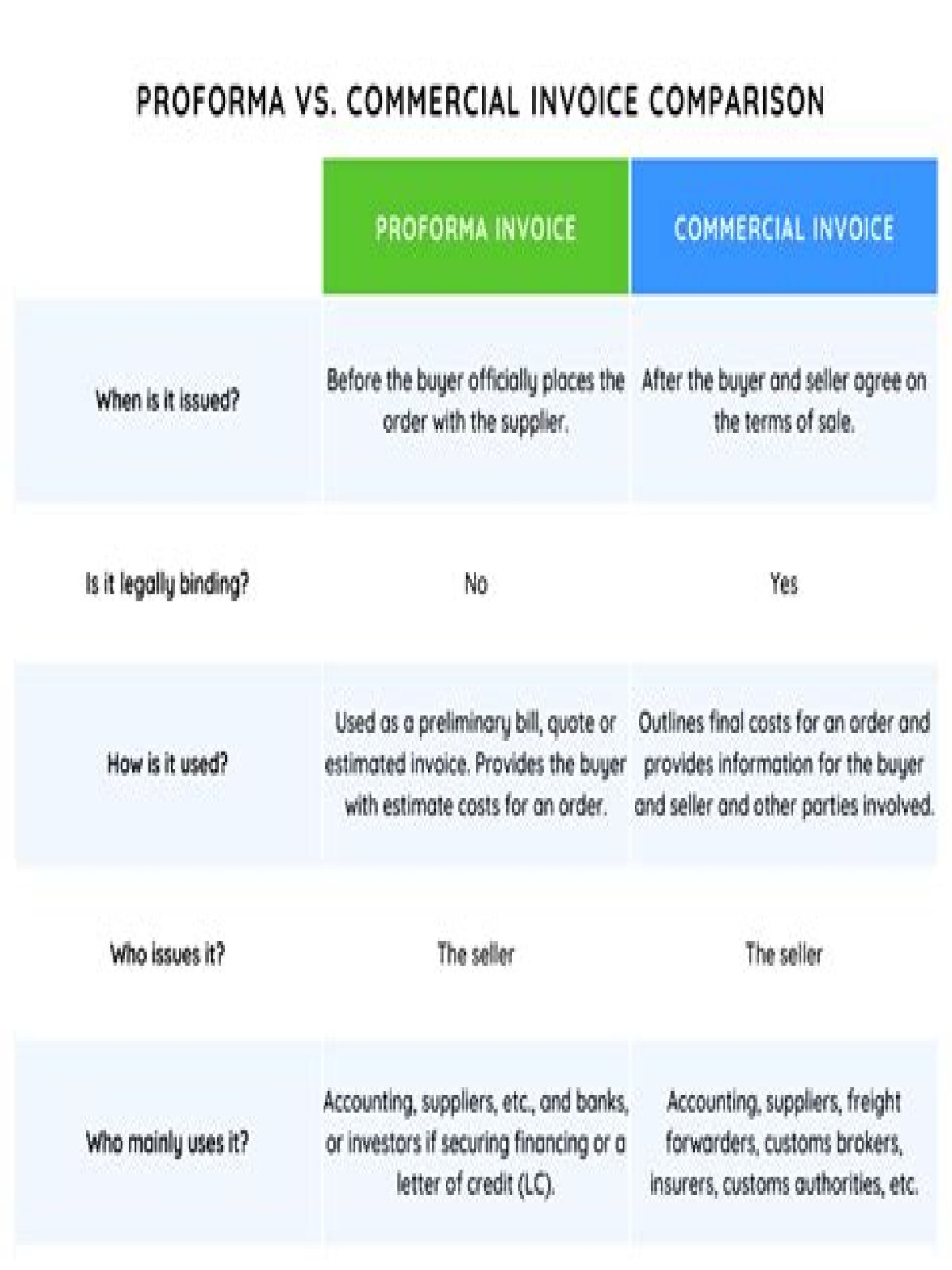

A pro forma invoice provides an estimate for the final amount of an order. A commercial invoice shows the final amount that should be paid. Pro forma invoices are used in importing and exporting to declare the value of goods for customs. Commercial invoices are used in accounting, to pay bills.

- Is proforma invoice A commercial document?

- What is meant by commercial invoice?

- What is the difference between a pro forma invoice and an invoice?

- When should a commercial invoice be issued?

- Is a proforma invoice a tax invoice?

- Should I pay a proforma invoice?

- Who provides a commercial invoice?

- What is the purpose of a pro forma?

- What should a commercial invoice include?

- Why are there 3 copies of commercial invoices?

- Why is commercial invoice important?

- What needs to be on a proforma invoice?

- Does a proforma invoice have an invoice number?

- Is a proforma invoice a legal binding document?

- What does proforma invoice mean?

- What are proforma financial statements?

- What is the difference between proforma and projected?

- What is pro forma revenue?

- What are the two types of invoices?

- What is commercial invoice in import?

- Do I need a commercial invoice to send documents?

- Does a commercial invoice need tax ID?

- Do you put VAT on a proforma invoice?

- What is proforma invoice why it is prepared?

Is proforma invoice A commercial document?

A Commercial Invoice document is issued to the buyer after the goods have been delivered or shipped. Also, the commercial invoice format is essentially the same as a proforma invoice. But importantly, the commercial invoice confirms the exact quantity of the products that have actually been loaded and shipped.

What is meant by commercial invoice?

The document recording a transaction between the seller and the buyer. Commercial invoices are normally prepared by sellers, and should include the following information: Date, names, and commercial addresses of the seller and the buyer. Precise denomination and quantity of goods.

What is the difference between a pro forma invoice and an invoice?

What Is the Difference Between an Invoice and Proforma Invoice? While an invoice is a commercial instrument that states the total amount due, the proforma invoice is a declaration by the seller to provide products and services on a specified date and time.When should a commercial invoice be issued?

The Commercial Invoice When the goods are ready to ship, the seller issues a commercial invoice. In addition to listing the amount owed by the buyer to the seller, including when and how payment must be made, the commercial invoice plays an important role in the export process.

Is a proforma invoice a tax invoice?

As a pro forma invoice does not act as an official tax invoice in the eyes of the tax office, it negates any obligation to report the transaction for either GST or income tax purposes until the issuer is certain of the goods being delivered and paid for.

Should I pay a proforma invoice?

A proforma invoice is a document a business sent to the customer before the details of the sale have been finalised. It’ll usually have the same format as a standard invoice, however, the document will be titled ‘proforma invoice’. … A customer is not legally required to pay the amount on a proforma invoice.

Who provides a commercial invoice?

The commercial invoice is one of the most important documents in international trade and ocean freight shipping. It is a legal document issued by the seller (exporter) to the buyer (importer) in an international transaction and serves as a contract and a proof of sale between the buyer and seller.What is the purpose of a pro forma?

Pro forma, a Latin term meaning “as a matter of form,” is applied to the process of presenting financial projections for a specific time period in a standardized format. Businesses use pro forma statements for decision-making in planning and control, and for external reporting to owners, investors, and creditors.

Is commercial invoice same as sales invoice?Unlike a regular sales invoice, a commercial invoice includes the necessary extra details for crossing the border, such as country of origin, harmonized system (HS) code, freights terms, and so on. In this guide, we will explain what a commercial invoice is, along with how to issue it and pack it for shipment.

Article first time published onWhat should a commercial invoice include?

- Sender’s name, address and contact details.

- Receiver’s name and address.

- Date of invoice (shipping date).

- Full description of each item of goods supplied to enable correct Customs Tariff Classification (catalogue and part numbers are not sufficient to describe the goods).

Why are there 3 copies of commercial invoices?

Generally, three copies of the commercial invoice are required when shipping from the UK: one for the country you are exporting from, one for the country you are shipping to and one for the recipient.

Why is commercial invoice important?

Meaning and Importance of a Commercial Invoice It is mainly used for clearance purposes with regard to customs and helps in the determination and assessment of duties and taxes payable. It contains the full description of goods sold, their quantities, and value as previously agreed upon by the parties.

What needs to be on a proforma invoice?

Like a regular invoice, proforma invoices should include contact details, a date of issue, a description of the goods or services provided, the total amount due, and any VAT. They might also include payment terms such as which methods of payment you accept and when payment is expected.

Does a proforma invoice have an invoice number?

A proforma invoice should not have an invoice number. Invoice numbers are reserved for completed invoices. Once a proforma invoice is finalised, the completed invoice should follow your invoice number sequence. The issue date of the proforma invoice doesn’t need to match the date of the finalised invoice.

Is a proforma invoice a legal binding document?

It is a legally binding agreement and is recorded in accounts payable. Whereas the proforma invoice is like a quotation, is not legally binding and is sent before the sale and details have been confirmed. A sales invoice can also serve as a tax invoice, since it includes VAT/GST and other taxes.

What does proforma invoice mean?

A proforma invoice is a preliminary bill or estimated invoice which is used to request payment from the committed buyer for goods or services before they are supplied. … It is essentially a “good faith” agreement between you (the seller) and a customer so the buyer knows what to expect ahead of time.

What are proforma financial statements?

A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn’t yet occurred. In the online course Financial Accounting, pro forma financial statements are defined as “financial statements forecasted for future periods.

What is the difference between proforma and projected?

Difference Between Pro Forma Financials and Financial Projections. … Financial projections are built on a set of assumptions, and can be built from scratch for a startup company. Pro Forma financial statements on the other hand are based on your current financial statements, and then are changed based on one event.

What is pro forma revenue?

Pro-forma earnings most often refer to earnings that exclude certain costs that a company believes result in a distorted picture of its true profitability. … The term may also refer to projected earnings included as part of an initial public offering or business plan (in Latin pro forma means “for the sake of form”).

What are the two types of invoices?

- Standard Invoice. A standard invoice is issued by a business and submitted to a client. …

- Credit Invoice. …

- Debit Invoice. …

- Mixed Invoice. …

- Commercial Invoice. …

- Timesheet Invoice. …

- Expense Report. …

- Pro Forma Invoice.

What is commercial invoice in import?

A commercial invoice is a legal document used for processing agreements in international trade. … The buyer/importer can then use this invoice – and other shipping documents – to clear the shipment at customs in the country of export and import.

Do I need a commercial invoice to send documents?

For Document Shipments Generally, an invoice is not required. Please consider each envelope or other package as one shipment.

Does a commercial invoice need tax ID?

Please include full details, including Tax ID, contact name, address with postal code and country, and phone number (very important). The waybill number is the tracking number shown on your shipping label (automatically generated when you create your ship ment in UPS® shipping systems).

Do you put VAT on a proforma invoice?

According to HMRC, proforma invoices aren’t considered to be commercial invoices or VAT invoices. As they aren’t considered to be VAT invoices, you can’t reclaim VAT using any proforma invoices that you’ve been sent by a supplier; instead you need a full, finalised invoice.

What is proforma invoice why it is prepared?

When is Pro forma invoice used? A pro forma invoice is made before the sale happens. For example, a supplier will issue a pro forma invoice if a customer requests him to produce a document for goods or services yet to be delivered. Hence, it is usually issued before the issue of tax/commercial invoice.