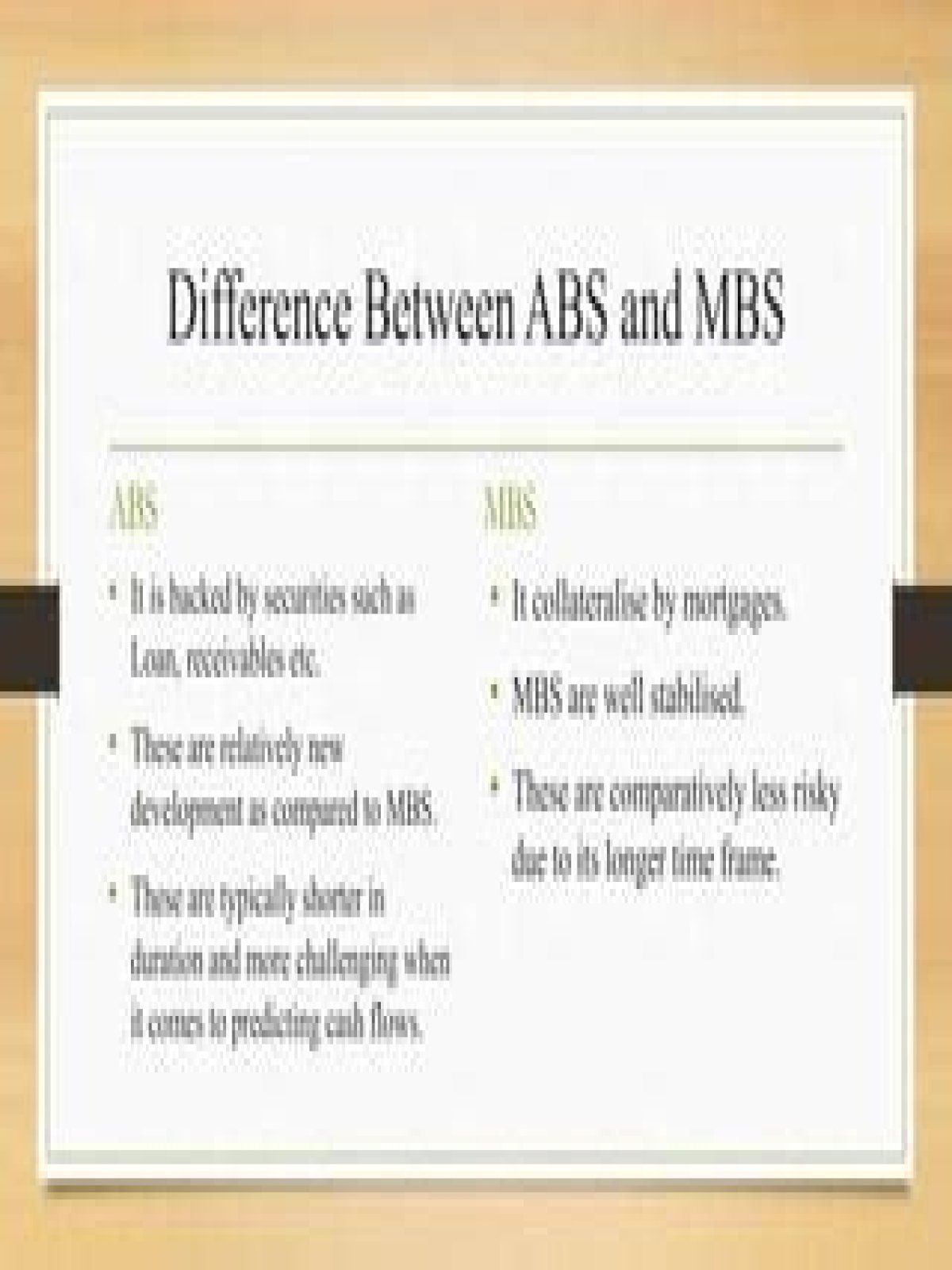

MBS are created from the pooling of mortgages that are sold to interested investors, whereas ABS is created from the pooling of non-mortgage assets. These securities are usually backed by credit card receivables, home equity loans, student loans, and auto loans.

- Are Asset-Backed Securities risky?

- What is mortgage-backed securities with example?

- What are ABS notes?

- What type of investments can be packaged into an ABS?

- How do I invest in ABS?

- What does it mean to collateralize a loan?

- Why is securitization bad?

- Who invests securitization?

- What is the difference between CDO and ABS?

- How do banks make money on mortgage-backed securities?

- Why did mortgage-backed securities fail?

- Do mortgage-backed securities still exist?

- Can retail investors buy ABS?

- What is average life of a bond?

- How are student loans packaged and sold?

- Can banks cross collateralize?

- What is the danger of putting up collateral for a loan?

- Why does an unsecured loan have a higher interest rate than a secured loan?

- How are ABS rated?

- Why are bonds fixed-income?

- What are tranches?

- Why do banks securitize loans?

- How do you securitize real estate?

- Why do companies go for securitization?

- What is securitization with example?

- Is a CDO a derivative?

- What is securitization of debt?

- How do banks make money on structured notes?

- Are CDOs still a thing?

Are Asset-Backed Securities risky?

Asset-backed securities are characterized by a diversified risk profile, as each security only contains a fraction of the total pool of underlying assets. When purchasing and asset-backed security, the investor receives all interest and principal payments but also takes on the risk of the underlying assets.

What is mortgage-backed securities with example?

Mortgage-backed securities, called MBS, are bonds secured by home and other real estate loans. They are created when a number of these loans, usually with similar characteristics, are pooled together. For instance, a bank offering home mortgages might round up $10 million worth of such mortgages.

What are ABS notes?

Asset-backed securities, called ABS, are bonds or notes backed by financial assets. Typically these assets consist of receivables other than mortgage loans,¹ such as credit card receivables, auto loans, manufactured-housing contracts and home-equity loans.What type of investments can be packaged into an ABS?

Asset-backed securities, also called “ABS,” are pools of loans that are packaged and sold to investors as securities—a process known as “securitization.”1 The type of loans that are typically securitized includes home mortgages, credit card receivables, auto loans (including loans for recreational vehicles), home …

How do I invest in ABS?

If you decide you want to invest in an ABS, you can purchase one at almost any brokerage firm. If you work with a financial advisor, they can assist you in selecting the most suitable ABS for your portfolio and cash flow needs.

What does it mean to collateralize a loan?

Collateralization is the use of a valuable asset to secure a loan. If the borrower defaults on the loan, the lender may seize the asset and sell it to offset the loss. Collateralization of assets gives lenders a sufficient level of reassurance against default risk.

Why is securitization bad?

Bad debts arise when borrowers default on their loans. This is one of the primary risks associated with securitized assets, such as mortgage-backed securities (MBS), as bad debts can stop these instruments’ cash flows. The risk of bad debt, however, can be apportioned among investors.Who invests securitization?

The largest investors in securitised assets are typically pension funds, insurance companies, investment fund managers, and to a lesser degree, commercial banks. The most compelling reason for investing in Asset-Backed Securities is their higher rate of return relative to other assets of comparable credit risk.

Is ABS a structured product?Securitization, structured products, structured credit, and asset-backed securities all refer to roughly the same thing: debt secured primarily by pools of “contractual obligations to pay.” Technically, RMBS and CMBS represent types of ABS.

Article first time published onWhat is the difference between CDO and ABS?

An ABS is a type of investment that offers returns based on the repayment of debt owed by a pool of consumers. A CDO a version of an ABS that may include mortgage debt as well as other types of debt. These types of investments are marketed mainly to institutions, not to individual investors.

How do banks make money on mortgage-backed securities?

Mortgage-backed securities (MBSs) are simply shares of a home loan sold to investors. They work like this: A bank lends a borrower the money to buy a house and collects monthly payments on the loan. … It’s also an excellent and safe way to make money when the housing market is booming.

Why did mortgage-backed securities fail?

Hedge funds, banks, and insurance companies caused the subprime mortgage crisis. Hedge funds and banks created mortgage-backed securities. … When the Federal Reserve raised the federal funds rate, it sent adjustable mortgage interest rates skyrocketing. As a result, home prices plummeted, and borrowers defaulted.

Do mortgage-backed securities still exist?

Mortgage-backed securities are still bought and sold today. There is a market for them again simply because people generally pay their mortgages if they can. The Fed still owns a huge chunk of the market for MBSs, but it is gradually selling off its holdings.

Can retail investors buy ABS?

If you decide you want to invest in an ABS, you can purchase one at almost any brokerage firm. If you work with a financial advisor, they can assist you in selecting the most suitable ABS for your portfolio and cash flow needs.

What is average life of a bond?

In loans, mortgages, and bonds, the average life is the average period of time before the debt is repaid through amortization or sinking fund payments. Investors and analysts use the average life calculation to measure the risk associated with amortizing bonds, loans, and mortgage-backed securities.

How are student loans packaged and sold?

1 Student loan asset-backed securities (SLABS) are exactly what they sound like, securities based on outstanding student loans. … By pooling and then packaging the loans into securities and selling them to investors, agencies can spread around the default risk, which allows them to give out more loans and larger loans.

Can banks cross collateralize?

Cross collateralization clauses can easily be overlooked, leaving people unaware of the multiple ways they might lose their property. Financial institutions often cross collateralize property if a customer takes out one of its loans and then follows up with other financing from that same bank.

What is the danger of putting up collateral for a loan?

The biggest risk of a collateral loan is you could lose the asset if you fail to repay the loan. It’s especially risky if you secure the loan with a highly valuable asset, such as your home. It requires you to have a valuable asset.

Why does an unsecured loan have a higher interest rate than a secured loan?

Typically, interest rates on unsecured loans are higher than rates on secured loans because the lender has a higher risk level of the loan not being repaid. Unsecured loans may be difficult to obtain if you do not have much positive credit history or don’t have a regular income.

How are ABS rated?

Credit ratings for ABSs are established by reviewing the structure of the deal and the parties involved, the nature and performance history of the collateral, the special purpose entity used to securitize the collateral and issue the resulting notes, and by an analysis of the credit enhancements used to protect the …

Why are bonds fixed-income?

Fixed-income securities provide a fixed interest payment regardless of where interest rates move during the life of the bond. If rates rise, existing bondholders might lose out on the higher rates. Bonds issued by a high-risk company may not be repaid, resulting in loss of principal and interest.

What are tranches?

- Tranches are pieces of a pooled collection of securities, usually debt instruments, that are split up by risk or other characteristics in order to be marketable to different investors.

- Tranches carry different maturities, yields, and degrees of risk—and privileges in repayment in case of default.

Why do banks securitize loans?

Banks may securitize debt for several reasons including risk management, balance sheet issues, greater leverage of capital, and in order to profit from origination fees. … The bank then sells this group of repackaged assets to investors.

How do you securitize real estate?

Generally there are four basic elements to securitization: (1) Assets generating the cash ffow that are to be securitized (underlying asset), (2) Investors that invest in the cash ffows generated by the underlying asset, (3) An SPE that functions as the conduit linking the underlying asset and investors (often referred …

Why do companies go for securitization?

Securitization converts loan relationships into capital market commodities and therefore, increases the power of the capital market. Debate on the potential risks of the capital market-financial market connectivity was initiated (or carried forward) by Prof Henry Kaufman.

What is securitization with example?

Securitization is the process of taking an illiquid asset or group of assets and, through financial engineering, transforming it (or them) into a security. … A typical example of securitization is a mortgage-backed security (MBS), a type of asset-backed security that is secured by a collection of mortgages.

Is a CDO a derivative?

A collateralized debt obligation (CDO) is a complex structured finance product that is backed by a pool of loans and other assets and sold to institutional investors. A CDO is a particular type of derivative because, as its name implies, its value is derived from another underlying asset.

What is securitization of debt?

Securitization is the process of converting a batch of debts into a marketable security that is backed, or securitized, by the original debts. Most debt securities are made up of loans such as mortgages made by banks to their customers. However, any receivables-based financial asset can support a debt security.

How do banks make money on structured notes?

Structured notes are typically sold by brokers, who receive commissions averaging about 2% from the issuing bank. While investors don’t pay these fees directly, they’re built into the principal value as a markup or embedded fee.

Are CDOs still a thing?

The CDO market exists since there’s a market of investors who are willing to buy tranches–or cash flows–in what they believe will yield a higher return to their fixed income portfolios with the same implied maturity schedule.