When prioritizing loan repayments, it’s a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans. Because an unsubsidized loan continues accruing interest while in school, the balance of your unsubsidized loans will be larger unless you paid the interest while in school.

- Should student loans be paid off first?

- How do I know which loan to pay off first?

- When starting to pay for school which loans should you consider first?

- Is it better to pay off student loan in lump sum?

- Why shouldn't you pay off student loans early?

- Do student loans go away after 7 years?

- Does paying off a student loan help credit?

- Is paying off student loans early bad for credit?

- Which Student Loan has the highest interest rate?

- Should I pay off unsubsidized loans first Reddit?

- When should you begin paying off your student loans?

- What is the avalanche method?

- Is it better to pay off debt or save?

- Whats the lowest you can pay on student loans?

- Can I pay off student loans all at once?

- Can I make extra payments on student loans?

- Can student loans take your house?

- What happens if I never pay my student loans?

- Are student loans forgiven at age 65?

- How can I pay off my student loans in 5 years?

- Do student loans affect your ability to buy a house?

- Is 700 a good credit score?

- How do I get my credit score to 800?

- Can you have a credit score of 900?

- What credit score is excellent?

- Do you pay back an unsubsidized loan?

- How can I increase my student loan amount?

- Can a defaulted student loan be forgiven?

- Will student loan interest rates go up in 2021?

Should student loans be paid off first?

Yes, paying off your student loans early is a good idea. … Paying off your private or federal loans early can help you save thousands over the length of your loan since you’ll be paying less interest. If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans.

How do I know which loan to pay off first?

Rather than focusing on interest rates, you pay off your smallest debt first while making minimum payments on your other debt. Once you pay off the smallest debt, use that cash to make larger payments on the next smallest debt. Continue until all your debt is paid off.

When starting to pay for school which loans should you consider first?

Pay off the student loan with the highest interest rate first. That will save you the most money over time. But if getting rid of small balances one by one motivates you more, go that route regardless of interest rate.Is it better to pay off student loan in lump sum?

Even if you want to pay off your student loans in a lump sum, make sure to fund your emergency fund first, no matter what. … If you use all your cash to pay off a student loan, hoping to save on interest, you’ll just wind up paying a higher rate when you use your credit card to finance an emergency.

Why shouldn't you pay off student loans early?

Paying off student loans early means you may not receive that tax deduction down the road. You shouldn’t keep your loans around just for the tax deduction, but if you have other things to do with your money, it’s nice to know that your student loans aren’t such a huge resource drain.

Do student loans go away after 7 years?

Student loans don’t go away after 7 years. There is no program for loan forgiveness or loan cancellation after 7 years. However, if it’s been more than 7.5 years since you made a payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report.

Does paying off a student loan help credit?

Paying off the loan in full looks good on your credit history, but it may not have a dramatic impact on your credit score. … Your positive payment history on the account will remain part of your credit report for up to 10 years and will thus have some positive impact on your credit for years to come.Is paying off student loans early bad for credit?

If you choose to pay student loans off early, there should be no negative effect on your credit score or standing. However, leaving a student loan open and paying monthly per the terms will show lenders that you’re responsible and able to successfully manage monthly payments and help you improve your credit score.

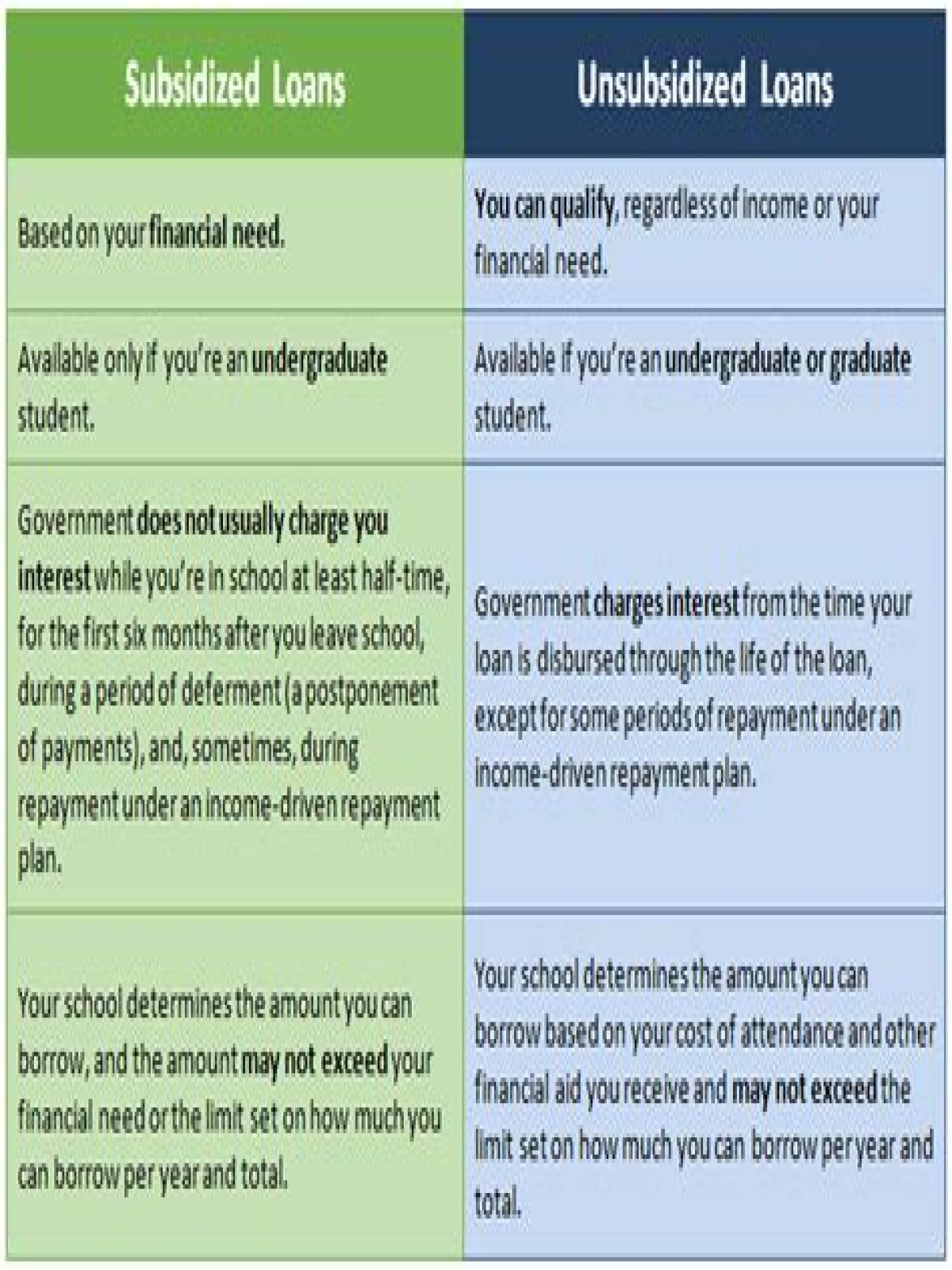

Is subsidized or unsubsidized better?What’s the difference between Direct Subsidized Loans and Direct Unsubsidized Loans? In short, Direct Subsidized Loans have slightly better terms to help out students with financial need.

Article first time published onWhich Student Loan has the highest interest rate?

Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At 7.08%, these have the highest interest rate of any federal student loan. It should be noted that there is an aggregate limit to how much money students may borrow on federal loans.

Should I pay off unsubsidized loans first Reddit?

Which means you’ll want to pay the unsubsidized first, since you’re paying your own interest there.” However, if you are not in school and are no longer in the 6-month grace period post-graduation, many reddit users recommend that you start by paying off your loan with the highest interest rate.

When should you begin paying off your student loans?

When do you start paying off student loans? You must start repaying federal student loans six months after you graduate, unenroll, or drop below half-time enrollment. 8 If you have private student loans, your repayment terms may be different—you may even need to make payments while you’re in school.

What is the avalanche method?

The debt avalanche method involves making minimum payments on all debt, then using any extra funds to pay off the debt with the highest interest rate. The debt snowball method involves making minimum payments on all debt, then paying off the smallest debts first before moving on to bigger ones.

Is it better to pay off debt or save?

Our recommendation is to prioritize paying down significant debt while making small contributions to your savings. Once you’ve paid off your debt, you can then more aggressively build your savings by contributing the full amount you were previously paying each month toward debt.

Whats the lowest you can pay on student loans?

The monthly payment can be no less than 50% and no more than 150% of the monthly payment under the standard repayment plan. The monthly payment must be at least the interest that accrues, and must also be at least $25.

Can I pay off student loans all at once?

Yes, you can pay your student loan in full at any time. If you are financially able to do so, it may make sense for you to pay off your student loans early. Lenders typically call this “prepayment in full.” Generally, there are no penalties involved in paying off your student loans early.

Can I make extra payments on student loans?

Yes. You can make payments before they are due or pay more than the amount due each month. Paying more than your required monthly payment can reduce the amount of interest you pay, and total loan cost over the life of the loan.

Can student loans take your house?

Student loans are unsecured loans. As a result, student loans can’t take your house if you make your payments on time. However, if you miss enough student loan payments, your accounts will first move into delinquency status and then into default status.

What happens if I never pay my student loans?

Let your lender know if you may have problems repaying your student loan. Failing to pay your student loan within 90 days classifies the debt as delinquent, which means your credit rating will take a hit. After 270 days, the student loan is in default and may then be transferred to a collection agency to recover.

Are student loans forgiven at age 65?

The federal government doesn’t forgive student loans at age 50, 65, or when borrowers retire and start drawing Social Security benefits. So, for example, you’ll still owe Parent PLUS Loans, FFEL Loans, and Direct Loans after you retire.

How can I pay off my student loans in 5 years?

- Establish your goals. To stay motivated, think about your personal and financial goals. …

- Build a budget. …

- Cut expenses. …

- Increase your income. …

- Look for grants and assistance programs. …

- Check with your employer. …

- Consider refinancing your loans.

Do student loans affect your ability to buy a house?

Your monthly student loan payment along with your income can affect your ability to buy a home. … Student loans don’t affect your ability to get a mortgage any differently than other types of debt you may have, including auto loans and credit card debt.

Is 700 a good credit score?

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750.

How do I get my credit score to 800?

- Build or Rebuild Your Credit History. …

- Pay Your Bills on Time. …

- Keep Your Credit Utilization Rate Low. …

- Review Your Credit Score and Credit Reports. …

- Better Loan Approval Odds. …

- Lower Interest Rates. …

- Better Credit Card Offers. …

- Lower Insurance Premiums.

Can you have a credit score of 900?

A credit score of 900 is either not possible or not very relevant. … On the standard 300-850 range used by FICO and VantageScore, a credit score of 800+ is considered “perfect.” That’s because higher scores won’t really save you any money.

What credit score is excellent?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Do you pay back an unsubsidized loan?

Unlike a subsidized loan, you are responsible for the interest from the time the unsubsidized loan is disbursed until it’s paid in full. You can choose to pay the interest or allow it to accrue (accumulate) and be capitalized (that is, added to the principal amount of your loan).

How can I increase my student loan amount?

If you are a dependent student for financial aid purposes, and your parent wishes to request a PLUS (parent) Loan, or wishes to request a PLUS loan increase, he/she should submit a Federal PLUS loan request form to the Financial Aid Office.

Can a defaulted student loan be forgiven?

Forgiveness isn’t an option for defaulted loans. You’ll need to use consolidation or rehabilitation to get defaulted federal student loans in good standing before they’re eligible for forgiveness programs.

Will student loan interest rates go up in 2021?

The interest rates on federal student loans are set by Congress and can change each year. For the 2021-22 academic year, the interest rates on federal Direct Loans will be rising.