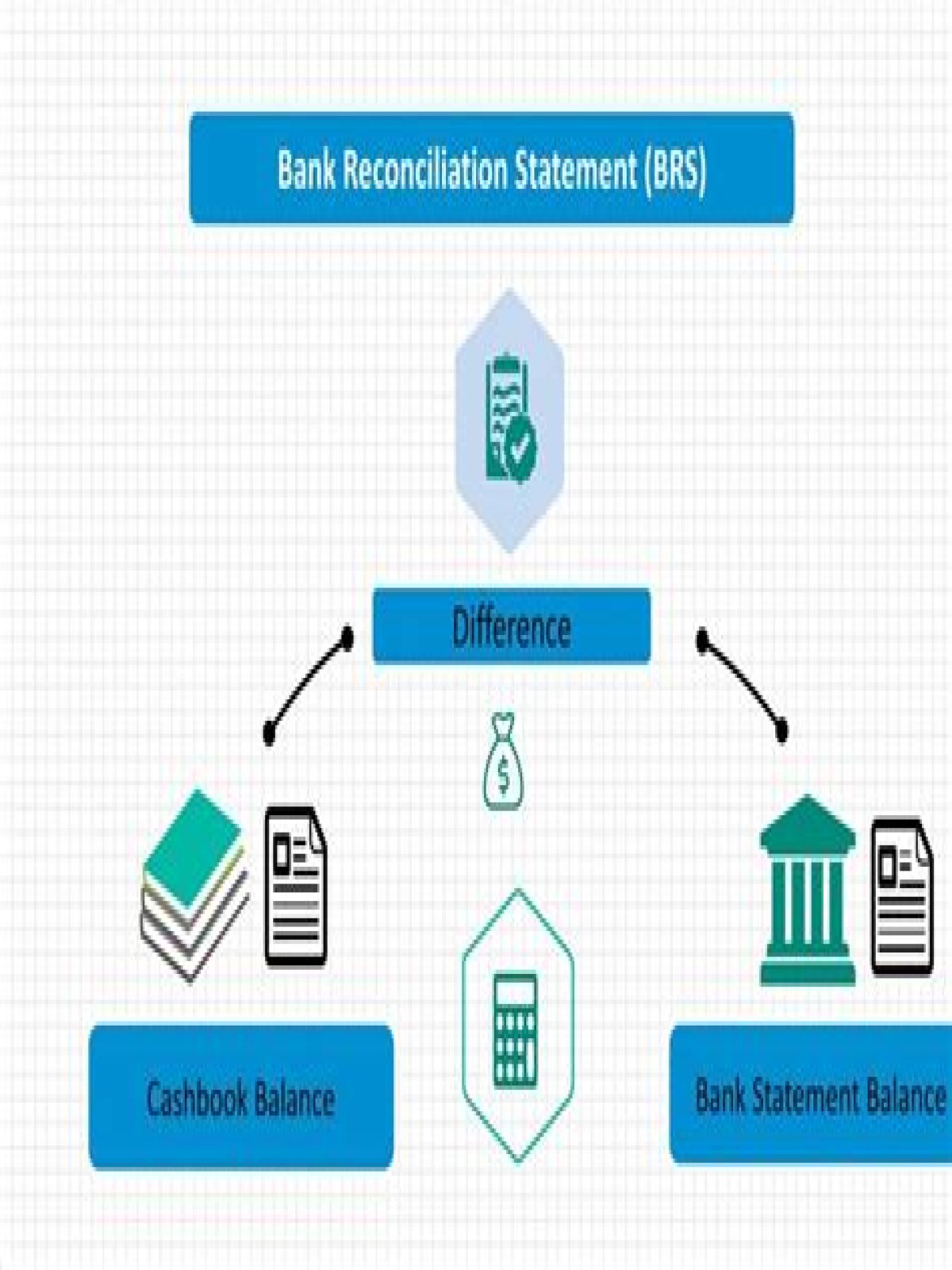

To do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions.

- What are the three methods of bank reconciliation?

- What are 4 types of bank reconciliation?

- What is a bank reconciliation and how is it completed?

- What are the 5 steps for bank reconciliation?

- Who should prepare a bank reconciliation?

- What is reconciliation with example?

- What is the journal entry for bank reconciliation?

- Who should prepare a bank reconciliation and how often should it be done?

- What is the need for preparation of bank reconciliation statement?

- What is business specific reconciliation?

- How do you prepare a reconciliation statement?

- How do I do a vendor reconciliation in Excel?

- What are the methods of reconciliation?

- Why it is important for a business to do a bank reconciliation monthly?

- What are the importance of a bank reconciliation to a business company?

- What are the reconciling items of bank reconciliation?

- How do you review a bank reconciliation?

- Is it necessary to do bank reconciliation?

- What are the two most common causes for people not being able to reconcile their bank statements accurately?

- How do you record errors in bank reconciliation?

- How do you write a bank reconciliation statement?

- What is Vlookup formula?

- What is example of bank reconciliation?

- What are bank reconciliation and budgets?

What are the three methods of bank reconciliation?

There are three steps: comparing your statements, adjusting your balances, and recording the reconciliation.

What are 4 types of bank reconciliation?

It’s easier to understand account reconciliation by taking a closer look at some common reconciliation examples. There are five main types of account reconciliation: bank reconciliation, customer reconciliation, vendor reconciliation, inter-company reconciliation and business-specific reconciliation.

What is a bank reconciliation and how is it completed?

The bank reconciliation process involves comparing the internal and bank records for a bank account, and adjusting the internal records as necessary to bring the two into alignment. This is done to ensure that an organization’s recorded cash balance is accurate.What are the 5 steps for bank reconciliation?

- Get bank records.

- Gather your business records.

- Find a place to start.

- Go over your bank deposits and withdrawals.

- Check the income and expenses in your books.

- Adjust the bank statements.

- Adjust the cash balance.

- Compare the end balances.

Who should prepare a bank reconciliation?

The accountant typically prepares the bank reconciliation statement using all transactions through the previous day, as transactions may still be occurring on the actual statement date. All deposits and withdrawals posted to an account must be used to prepare a reconciliation statement.

What is reconciliation with example?

A reconciliation involves matching two sets of records to see if there are any differences. … Examples of reconciliations are: Comparing a bank statement to the internal record of cash receipts and disbursements. Comparing a receivable statement to a customer’s record of invoices outstanding.

What is the journal entry for bank reconciliation?

The journal entries for the bank fees would debit Bank Service Charges and credit Cash. The journal entry for a customer’s check that was returned due to insufficient funds will debit Accounts Receivable and will credit Cash.Who should prepare a bank reconciliation and how often should it be done?

In general, all businesses should do bank reconciliations at least once a month. It is convenient to reconcile the books immediately after the end of the month because banks send monthly statements at the conclusion of each month that can be used as a basis for the reconciliation.

What is bank reconciliation in simple words?A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate.

Article first time published onWhat is the need for preparation of bank reconciliation statement?

A Bank Reconciliation Statement is needed and is important because of the following reasons: It helps in knowing the actual Bank balance. It helps in discouraging the staff from embezzlement. Helps in identifying the reason for differences in the Cash Book and the Pass Book.

What is business specific reconciliation?

Business specific reconciliation These are unique and relate to the specifics of individual businesses. For example, companies which sell goods will need to conduct a stock take to ensure that the inventory value in the balance sheet accurately reflects the value of goods held in storage.

How do you prepare a reconciliation statement?

- Check for Uncleared Dues. …

- Compare Debit and Credit Sides. …

- Check for Missed Entries. …

- Correct them. …

- Revise the Entries. …

- Make BRS Accordingly. …

- Add Un-presented Cheques and Deduct Un-credited Cheques. …

- Make Final Changes.

How do I do a vendor reconciliation in Excel?

- Request Party to Give Our Company’s Ledger in their books (preferably in excel format)

- Open Party Ledger in our books and Export in Excel.

- Copy paste both in One Excel file.

What are the methods of reconciliation?

- Compare internal cash register to the bank statement. …

- Identify payments recorded in the internal cash register and not in the bank statement (and vice-versa) …

- Confirm that cash receipts and deposits are recorded in the cash register and bank statement. …

- Watch out for bank errors.

Why it is important for a business to do a bank reconciliation monthly?

Bank reconciliations have multiple objectives: Ensures accuracy of transactions (i.e. are amounts recorded correctly) Ensures the existence of transactions (i.e. are amounts appearing on the bank or credit card statement are showing up in the accounting system and vice versa) Catching fraud before it’s too late.

What are the importance of a bank reconciliation to a business company?

The purpose of a bank reconciliation. A bank reconciliation is used to compare your records to those of your bank, to see if there are any differences between these two sets of records for your cash transactions.

What are the reconciling items of bank reconciliation?

Examples of reconciling items in a bank reconciliation are deposits in transit and uncashed checks. Some reconciling items may require adjustment to the records of the recording entity, such as an uncashed check fee that has been imposed by the entity’s bank.

How do you review a bank reconciliation?

- Check the dates. …

- Check the cashbook balance. …

- Check the bank statement balance. …

- Check the structure of the reconciliation statement. …

- Check the outstanding items listed on the reconciliation statement. …

- Check some cashbook entries.

Is it necessary to do bank reconciliation?

Reconciling your bank statements simply means comparing your internal financial records against the records provided to you by your bank. This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors.

What are the two most common causes for people not being able to reconcile their bank statements accurately?

- Math Errors. One of the most common reasons a bank reconciliation doesn’t come out right is because of math errors. …

- Outstanding Checks. …

- Electronic Fees. …

- Potential Fraud.

How do you record errors in bank reconciliation?

Recording errors should be added or subtracted from the book balance. If the item cleared the bank for less than the amount in the books, add the amount of the error. If the item cleared the bank for more than the amount in the books, subtract the amount of the error.

How do you write a bank reconciliation statement?

Bank Reconciliation Procedure Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks. This will provide the adjusted bank cash balance. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount.

What is Vlookup formula?

In its simplest form, the VLOOKUP function says: … =VLOOKUP(What you want to look up, where you want to look for it, the column number in the range containing the value to return, return an Approximate or Exact match – indicated as 1/TRUE, or 0/FALSE).

What is example of bank reconciliation?

Bank Reconciliation Example – 1 A cheque of $300 was deposited, but not collected by the bank. Bank charges of $50 were recorded in Passbook, but not in Cash Book. Cheques worth $200 were issued, but not presented for payment. Bank interest of $100 was recorded in Passbook, but not in Cash Book.

What are bank reconciliation and budgets?

Definition: Budget reconciliation is the process of reviewing transactions and supporting documentation, and resolving any discrepancies that are discovered. The process encompasses two different activities or roles: … High level budget review and analysis by a person accountable for the budget (budget reviewer).