For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

- How long does it take to get a payoff from the IRS?

- How do I check for IRS liens?

- Do IRS liens expire?

- Do liens show up on credit reports?

- What happens to a federal tax lien after 10 years?

- Will the IRS subordinate a tax lien?

- Can the IRS put a lien on your bank account?

- Does IRS file a tax lien with an installment agreement?

- Can you refinance with an IRS lien?

- Can the IRS force you to sell your house?

- Can the IRS refile a tax lien after 10 years?

- Can I buy a house with a IRS lien?

- How long before a tax lien becomes a levy?

- How do I get a tax lien removed from my credit report?

- Is a tax lien bad?

- How bad is a lien?

- What is the statute of limitations for IRS collections?

- How many notices does the IRS send before levy?

- What is a Notice 1450 from the IRS?

- Is there a one time tax forgiveness?

- Does IRS debt go away after 7 years?

- What is the IRS Fresh Start Program?

- Will I get my tax refund if I owe the IRS?

- What happens if you owe the IRS money and don't pay?

- What is a frozen refund?

- Can the IRS seize your bank account without notice?

- How Long Can IRS freeze your account?

- How do I pay off my IRS installment agreement early?

- How do liens work?

How long does it take to get a payoff from the IRS?

Payoff computations may take up to 14 calendar days to process. The successfully completed fax transmission, or mailing certification, serves as the acknowledgement of the request.

How do I check for IRS liens?

How to Look Up a Federal Tax Lien. The IRS has a department called the Centralized Lien Unit that you can contact at (800) 913-6050, and you will be able to find out if the IRS has placed a lien on your property.

Do IRS liens expire?

If you have failed to pay your tax debt after receiving a Notice and Demand for Payment from the IRS and are now facing a federal tax lien, you may be wondering when the lien will expire. At a minimum, IRS tax liens last for 10 years.Do liens show up on credit reports?

Though liens themselves are not included in your reports, if the lien was involuntarily, it’s likely due to nonpayment. In that case, if the creditor that filed the lien reports payment information to the credit bureaus, a record of nonpayment could be listed in your reports and negatively impact your scores.

What happens to a federal tax lien after 10 years?

After the 10 year statute of limitations on collections expires, the IRS is required to release the lien. To accomplish this on a wide scale, the IRS inserts language into the lien that makes it “self-releasing.” That means it is automatically released when the 10 years is up.

Will the IRS subordinate a tax lien?

The IRS may subordinate the tax lien if you agree to pay them an amount equal to the interest they are subordinating.

Can the IRS put a lien on your bank account?

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.Does IRS file a tax lien with an installment agreement?

The IRS can file a tax lien even if you have an agreement to pay the IRS. … If your unpaid balance is between $25,000 and $50,000, the IRS won’t file a tax lien if you allow the IRS to take installment agreement payments directly from your bank account or wages.

Does a tax lien hurt your credit?Tax liens, or outstanding debt you owe to the IRS, no longer appear on your credit reports—and that means they can’t impact your credit scores.

Article first time published onCan you refinance with an IRS lien?

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. … Taxpayers or lenders also can ask that a federal tax lien be made secondary to the lending institution’s lien to allow for the refinancing or restructuring of a mortgage.

Can the IRS force you to sell your house?

The IRS cannot sell your house without first getting a court judgment approving the sale. Court approval is required by law – Internal Revenue Code 6334(e) requires a U.S. District Court judge to approve an IRS sale of a personal residence before it can be sold. … There is a court process that must be exhausted first.

Can the IRS refile a tax lien after 10 years?

The time the IRS has to refile a notice of Federal Tax Lien has a beginning and end date. The refiling period is a 12 month period. This one year period the IRS has to refile the tax lien is the one year period ending 30 days after the ten-year period following the assessment of the tax for which the lien was filed.

Can I buy a house with a IRS lien?

A: The short answer is “no.” The tax lien shouldn’t prevent you from buying a home, unless the IRS is required to be in a first-lien position against your prospective home. While the FHA program will probably be the easiest avenue available to you, you could also consider a loan guaranteed by Fannie Mae or Freddie Mac.

How long before a tax lien becomes a levy?

Contrary to popular belief, the IRS does not have to record an NFTL before it can levy bank accounts or receivables. Once the Final Notice has been issued and 30 days have passed, the IRS can levy bank accounts and/or accounts receivable. The IRS does not perform a lien search prior to issuing a levy.

How do I get a tax lien removed from my credit report?

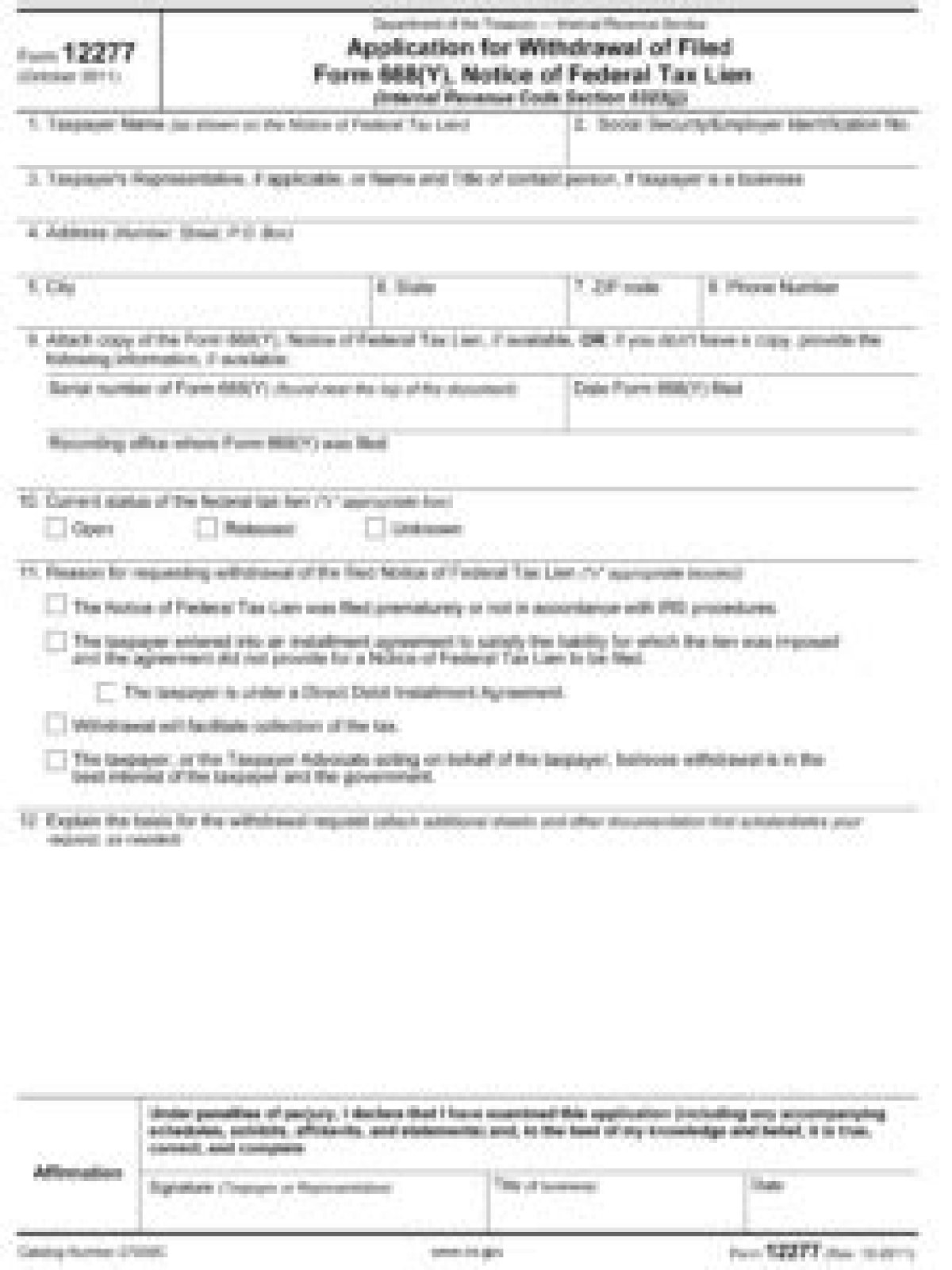

- Step 1: Complete IRS Form 12277. …

- Step 2: Send Form 122277 to the IRS. …

- Step 3: Wait for response from IRS. …

- Step 4: Dispute the lien with the Credit Reporting Agencies. …

- Step 5: Final confirmation.

Is a tax lien bad?

Tax liens are serious. If you have a lien on your home or property, you probably haven’t paid all your federal or state income taxes. Liens don’t lead to property seizure right away, but they’re only one step away from levies—and levies mean business.

How bad is a lien?

A lien gives an individual or entity a claim to a property until a debt is paid off. If the debt goes unpaid, they have the right to take it back. … It’s generally considered to be a bad thing if you have a lien on your property.

What is the statute of limitations for IRS collections?

Generally, under IRC § 6502, the IRS will have 10 years to collect a liability from the date of assessment. After this 10-year period or statute of limitations has expired, the IRS can no longer try and collect on an IRS balance due. However, there are several things to note about this 10-year rule.

How many notices does the IRS send before levy?

Normally, you will get a series of four or five notices from the IRS before the seize assets. Only the last notice gives the IRS the legal right to levy.

What is a Notice 1450 from the IRS?

This notice is used by courts to establish priority, as in bankruptcy proceedings or sales of real estate. Releasing a Lien. … State or local government charges to file and release the lien are added to the amount you owe. See IRS Publication 1450, Request for Release of Federal Tax Lien.

Is there a one time tax forgiveness?

Yes, the IRS does offers one time forgiveness, also known as an offer in compromise, the IRS’s debt relief program.

Does IRS debt go away after 7 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations. … Therefore, many taxpayers with unpaid tax bills are unaware this statute of limitations exists.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is an umbrella term for the debt relief options offered by the IRS. The program is designed to make it easier for taxpayers to get out from under tax debt and penalties legally. Some options may reduce or freeze the debt you’re carrying.

Will I get my tax refund if I owe the IRS?

Can I receive a tax refund if I am currently making payments under an installment agreement or payment plan for another federal tax period? No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe.

What happens if you owe the IRS money and don't pay?

If you filed on time but didn’t pay all or some of the taxes you owe by the deadline, you could face interest on the unpaid amount and a failure-to-pay penalty. The failure-to-pay penalty is equal to one half of one percent per month or part of a month, up to a maximum of 25 percent, of the amount still owed.

What is a frozen refund?

If you prove to the IRS that you correctly took the deductions and/or credits, the IRS will issue your refund or corrected refund. The IRS can freeze your refund if it’s auditing your past tax returns and thinks you’ll owe additional taxes in the audit.

Can the IRS seize your bank account without notice?

You have due process rights. The IRS can no longer simply take your bank account, automobile, or business, or garnish your wages without giving you written notice and an opportunity to challenge its claims. … Tax Court cases can take a long time to resolve and may keep the IRS from collecting for years.

How Long Can IRS freeze your account?

If the bank does not comply with a levy, the IRS can hold them responsible for the tax debt and add penalties equal to 50% of the tax liability. The 21-day freeze allows the taxpayer time to appeal.

How do I pay off my IRS installment agreement early?

There’s no penalty for paying off your IRS payment plan early. In fact, if you pay tax debt quickly, it’s likely the installment plan fee will be waived. You can avoid the fee by paying the full amount within 120 days. Apply online to specify this option to pay taxes.

How do liens work?

Creditors place liens on property to secure the debt you own them. Liens can give creditors the legal right to seize your property and sell it in order to obtain the money you own them, and may hinder property owners from selling their home until the debt they are owed has been settled.