Yes. According to the Insurance Information Institute, a landlord insurance policy costs about 25% more than a homeowners insurance policy for the same property. The primary reasons for the difference in cost revolve around who is occupying the home.

- Is homeowners insurance cheaper if rental property?

- What is the difference between rental property insurance and homeowners insurance?

- Does it cost more to insure a rental property?

- How much does it cost to insure a rental home?

- Does a rental property have to be insured?

- Is landlord insurance tax deductible?

- What expenses can I claim as a landlord?

- How can I reduce my landlord insurance?

- What type of people need renters insurance?

- What are three things that renters insurance covers?

- Why would someone want to have renters insurance if their building owner has insurance quizlet?

- What is a good cap rate for rental property?

- What is the most common source of insurance?

- What is not protected by homeowners insurance?

- How can I avoid paying tax on rental property?

- How much can you write off for rental property?

- Can you write off rental property?

- What is covered in landlord contents insurance?

- Who pays building insurance landlord or tenant?

- Who is responsible for accidental damage to rental property?

- Why is my landlord insurance so expensive?

- Are landlords responsible for noisy Neighbours?

- Why has my landlord insurance gone up?

- Can landlords still claim 10 wear and tear?

- Do you pay taxes on rental income?

- Can I deduct mortgage from rental income?

- What is the difference between landlord insurance and building insurance?

- What damage is a tenant liable for?

- Does landlord insurance cover windows?

Is homeowners insurance cheaper if rental property?

Yes. According to the Insurance Information Institute, a landlord insurance policy costs about 25% more than a homeowners insurance policy for the same property. The primary reasons for the difference in cost revolve around who is occupying the home.

What is the difference between rental property insurance and homeowners insurance?

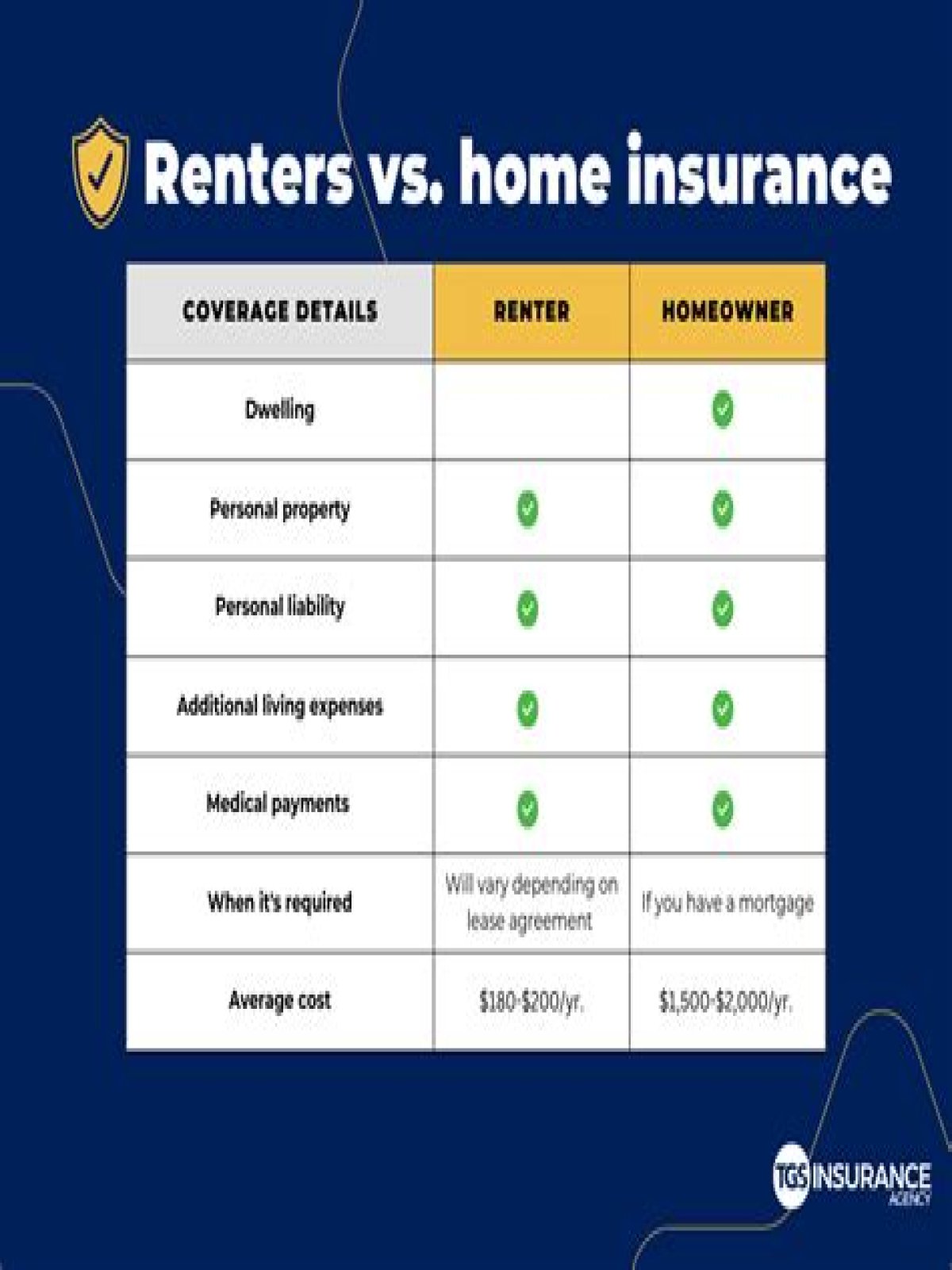

Homeowners insurance is for those who own their home or apartment, and it covers both their personal belongings and the structure of the home. Renters insurance is purchased by tenants, and it covers damage to or theft of their personal property, but not damage to the building itself.

Does it cost more to insure a rental property?

Rental property insurance is approximately 25% more expensive than an equivalent homeowners insurance policy. Given that the nationwide average cost of homeowners insurance is $1,445, you can expect the nationwide average for rental property insurance to be approximately $1,800.How much does it cost to insure a rental home?

How Much Does Rental Property Insurance Cost? Rental property insurance is generally 25% more expensive than a homeowners insurance policy. While the average cost of homeowners insurance is $1,445 per year ($120 per month), you can expect the cost of rental property insurance to be around $1,806 or $150 a month.

Does a rental property have to be insured?

Insurance is important for both landlords and tenants. Landlords should insure their rental property against any damage. Tenants should also have insurance for their belongings, and to protect them from liability.

Is landlord insurance tax deductible?

Landlord insurance premiums are also tax-deductible as a general rule, as are legal costs required to evict a tenant. A deductible cost that is often overlooked is travelling to inspect the property.

What expenses can I claim as a landlord?

- water rates, council tax, gas and electricity.

- landlord insurance.

- costs of services, including the wages of gardeners and cleaners (as part of the rental agreement)

- letting agents’ fees.

- legal fees for lets of a year or less, or for renewing a lease of less than 50 years.

How can I reduce my landlord insurance?

- Combine landlord policies. …

- Choose a specialist landlord insurer. …

- Get the correct rebuild value. …

- Consider increasing landlord insurance excesses. …

- Do you need contents insurance? …

- Invest in security. …

- Say no to pets. …

- Be choosey with your tenants.

Landlord insurance protects you as the property owner from financial losses connected to the rental, such as theft, fire, or weather damage and can be extended to include coverage for things like unpaid rent and malicious damage by tenants.

Article first time published onWhat type of people need renters insurance?

You’ll only need renters insurance if your landlord or your building requires it. While not required otherwise, anyone renting any type of residence long-term — be it an apartment or single-family home — should strongly consider purchasing a renters insurance policy.

What are three things that renters insurance covers?

Renters insurance typically includes three types of coverage: Personal property, liability and additional living expenses. Personal property coverage can help pay to replace your belongings if they’re stolen or damaged by a covered risk.

Why would someone want to have renters insurance if their building owner has insurance quizlet?

Why would someone want to have renters’ insurance if their building owner has insurance? The building owner’s insurance only covers the building structure. Renter’s insurance covers your personal property. What is the purpose of liability coverage on a renter’s insurance policy?

What is a good cap rate for rental property?

Generally, 4% to 10% per year is a reasonable range to earn for your investment property. Continuing with our two-bedroom house example from above, dividing the net operating income by a minimum acceptable cap rate of 5% will give you the top price you would be willing to pay: $15,800/ 5% = $316,000.

What is the most common source of insurance?

Of the subtypes of health insurance coverage, employment-based insurance was the most common, covering 54.4 percent of the population for some or all of the calendar year, followed by Medicare (18.4 percent), Medicaid (17.8 percent), direct-purchase coverage (10.5 percent), TRICARE (2.8 percent), and Department of …

What is not protected by homeowners insurance?

What Standard Homeowner Insurance Policies Don’t Cover. Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

How can I avoid paying tax on rental property?

Use a 1031 Exchange Section 1031 of the Internal Revenue Code allows you to defer paying capital gains tax on rental properties if you use the proceeds from the sale to purchase another investment.

How much can you write off for rental property?

Most small landlords can deduct up to $25,000 in rental property losses each year. A special tax rule permits some landlords to deduct 100% of their rental property losses every year, no matter how much. People who rent property to their family or friends can lose virtually all of their tax deductions.

Can you write off rental property?

You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. … Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance.

What is covered in landlord contents insurance?

Here are just some of the areas that may be covered by a landlord insurance policy: Accidental loss or damage to the property. Malicious damage caused by tenants, their family or visitors. Insured natural disasters such as fire, storm, rainwater, lightning and earthquake.

Who pays building insurance landlord or tenant?

The lease should state who is responsible for arranging and paying for buildings insurance. With most leases, the landlord arranges and pays for buildings insurance but then passes on the costs (or an appropriate proportion, in shared premises) either as part of the service charge or as a separately itemised charge.

Who is responsible for accidental damage to rental property?

Any damage that’s caused by the tenant or their guests falls to the tenant to repair. Damage that happens over time, like cracks in the wall or other types of wear and tear, is the responsibility of the property’s owner to fix, as it’s their duty to ensure their property is fit for someone to live in.

Why is my landlord insurance so expensive?

To understand why landlord insurance is typically more expensive than standard home insurance, it might be helpful to go back to the basics of insurance itself. Essentially, insurance is about risk and a calculation of the probability of loss or damage being suffered by the insured item or items.

Are landlords responsible for noisy Neighbours?

It is well established law that where a landlord authorises (expressly or impliedly) actions by its tenant that cause a nuisance, or it participates in that nuisance, then the landlord may be liable (along with its tenant) in nuisance to those that it impacts upon.

Why has my landlord insurance gone up?

The number of claims being made Also, if, overall, the number of landlord claims goes up – perhaps because of things like increased accidental damage claims or extreme weather events – this could mean the costs to insure your property could go up too.

Can landlords still claim 10 wear and tear?

Furnished property landlords could claim a 10% wear and tear allowance each year regardless of whether they spent any money on replacing furnishings or appliances. … Landlords could claim the cost of repairs and maintenance for both types of rental property.

Do you pay taxes on rental income?

Yes, rental income is taxable, but that doesn’t mean everything you collect from your tenants is taxable. … You report rental income and expenses on Schedule E, Supplemental Income and Loss. Schedule E is then filed with your Form 1040.

Can I deduct mortgage from rental income?

Landlords are no longer able to deduct mortgage interest from rental income to reduce the tax they pay. You’ll now receive a tax credit based on 20% of the interest element of your mortgage payments. This rule change could mean that you’ll pay a lot more in tax than you might have done before.

What is the difference between landlord insurance and building insurance?

Landlord insurance covers against risks related to your buy-to-let property and rental activity. … Buildings insurance covers the cost of repairing or rebuilding your property, while contents insurance covers your contents if they’re stolen or damaged.

What damage is a tenant liable for?

Ultimately, the tenant is responsible for any damage that they cause to the property they are renting. The damage should be reported as soon as possible, so that it can be repaired or at least assessed by either the landlord or a professional (tradesman etc.)

Does landlord insurance cover windows?

Building insurance covers the cost of repairs to anything permanently attached to the property. This includes guttering and pipes, external walls, fences and gates, driveways, doors, windows, but also many items inside the home.