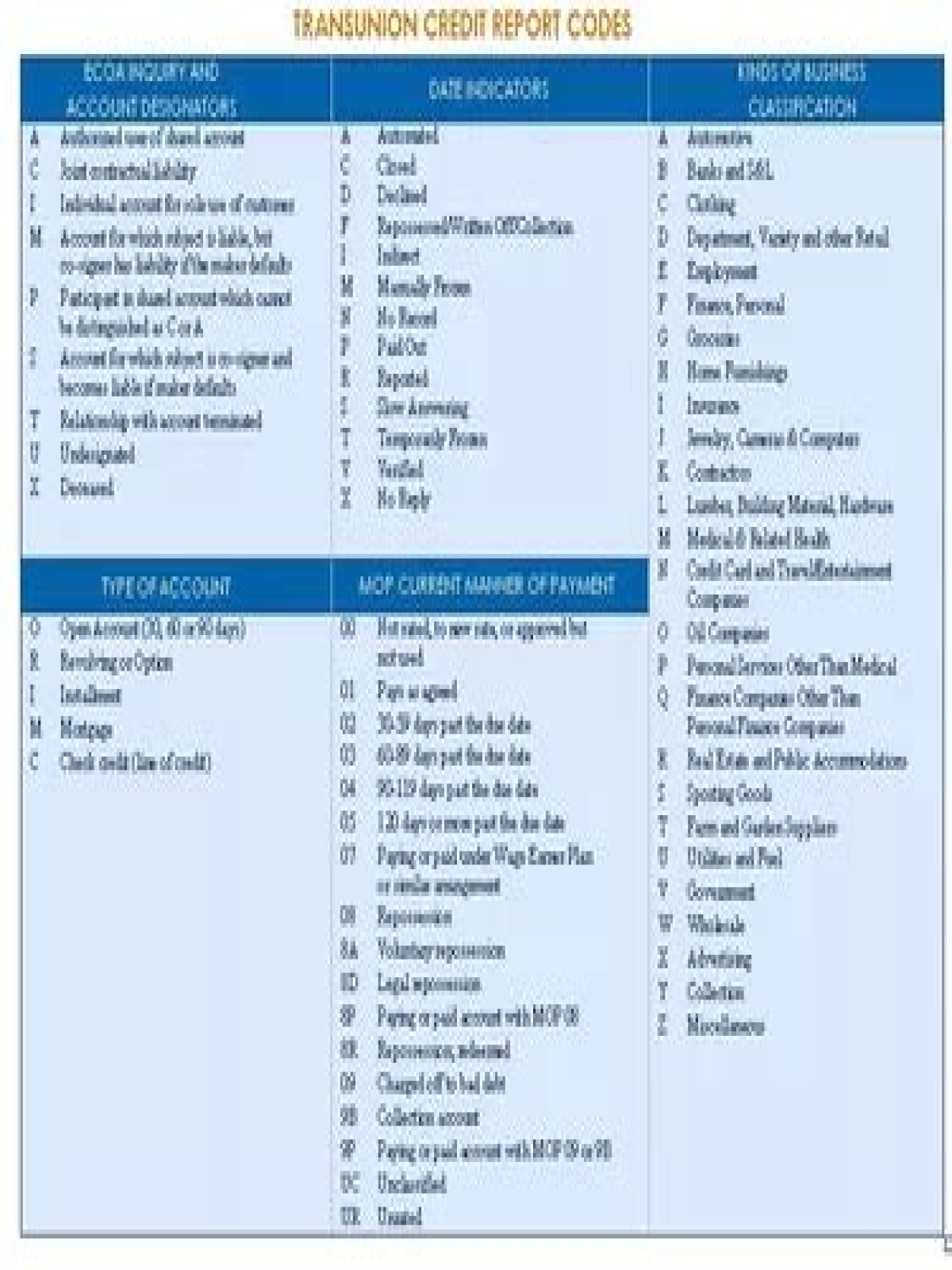

A – Authorized User. … I – Individual Account. … J – Joint Account. … M – Maker. … P – Participating Account. … S – Signer. … T – Terminated. … U – Undesignated.

- What does ECOA Code C mean on a credit report?

- What are some common ECOA issues?

- What do the codes mean on a credit report?

- What is ECOA?

- What does B mean on Experian credit report?

- What ECOA 3?

- What is a serious delinquency?

- What is the difference between hard inquiry and soft inquiry?

- What does BC mean on credit report?

- Does ECOA apply to all lenders?

- Does ECOA apply to all loans?

- Does ECOA apply to deposit accounts?

- Which type of credit transactions does the ECOA apply to?

- What are ECOA requirements?

- Who affects ECOA?

- How is the FHA act different from ECOA?

- What does BK 7 Petit mean?

- Is AB good for business credit?

- Can someone run your credit report without you knowing about it explain?

- How many points does a soft inquiry affect credit score?

- Does Credit Karma hurt your score?

- How many points does your credit score go down when you are rejected?

- Can a delinquency be removed?

- How do I remove delinquency from my credit report?

- How many points will my credit score increase when I pay off collections?

- Is it better to have a 0 balance on your credit card?

- What is the required credit score to buy a house?

- Can you get a home loan with 700 credit score?

- What does C1 mean on credit report?

What does ECOA Code C mean on a credit report?

C: Co-borrower’s account – An account solely for the co-borrower. J: Joint account – An account for which both spouses are contractually liable. M: Maker – An account where the borrower is primarily responsible, having a cosigner [or Co-maker] with no spousal relationship to assume liability if the borrower defaults.

What are some common ECOA issues?

- Race.

- Color.

- Religion.

- National origin.

- Sex / gender.

- Marital status.

- Age (unless a person is not of legal age to enter into a contract)

- Status as a public assistance recipient.

What do the codes mean on a credit report?

Installment Account (fixed number of paymentsRevolving or Option Account (Open-ended)MeaningI9R9Bad debt; placed for collectionIARAAccount is inactiveIBRBLost or stolen cardICRCContact member for statusWhat is ECOA?

The Federal Trade Commission (FTC), the nation’s consumer protection agency, enforces the Equal Credit Opportunity Act (ECOA), which prohibits credit discrimination on the basis of race, color, religion, national origin, sex, marital status, age, or because you get public assistance.

What does B mean on Experian credit report?

9 = 66, 67, 68, 86, 88, 91, 92, 93, 97, A, B, C, E, F, G, V, W, X. 0 = Current with zero balance reported on tape. – = No history reported that month. B = Account condition change/Payment code is not.

What ECOA 3?

3. Authorized User: Party is an authorized user of the account; another party has contractual responsibility. 5. Co-maker or Guarantor: Party guaranteed the account and assumes responsibility for the account if the maker defaults.

What is a serious delinquency?

A serious delinquency is when a single-family mortgage is 90 days or more past due and the bank considers the mortgage in danger of default. … A past-due mortgage is considered a sign to the lender that the mortgage is at high risk for defaulting.What is the difference between hard inquiry and soft inquiry?

Hard inquiries appear when you’ve given someone permission to check your credit report in order to process a credit or loan application — these can also lower your score. … Soft credit inquiries don’t harm your credit score but do involve someone checking your score.

What is an excellent credit score?Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Article first time published onWhat does BC mean on credit report?

BC Services is a debt collection agency. They’re probably on your credit report as a ‘collections’ account.

Does ECOA apply to all lenders?

The Equal Credit Opportunity Act (ECOA), which is implemented by Regulation B, applies to all creditors. When originally enacted, ECOA gave the Federal Reserve Board responsibility for prescribing the implementing regulation.

Does ECOA apply to all loans?

ECOA applies to various types of loans including car loans, credit cards, home loans, student loans, and small business loans.

Does ECOA apply to deposit accounts?

Answer: Regulation B applies to credit products – so the answer would be no, as neither the regulation nor the commentary addresses the application of adverse action to non-credit products. However, the amended Section 615(a) of the FCRA would apply to any type of adverse action (deposit accounts, insurance, etc.)

Which type of credit transactions does the ECOA apply to?

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

What are ECOA requirements?

The Equal Credit Opportunity Act (ECOA), enacted in 1974, and its implementing rules (known as Regulation B) prohibit creditors from discriminating on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to contract), because all or part of an …

Who affects ECOA?

The law applies to any organization that extends credit, including banks, small loan and finance companies, retail and department stores, credit card companies, and credit unions. It also applies to anyone involved in the decision to grant credit or set its terms—for example, real estate brokers who arrange financing.

How is the FHA act different from ECOA?

Where the ECOA protects borrowers from discrimination when applying for credit, the Federal Fair Housing Act prohibits discrimination in the sale, rental, and financing of homes, among other housing-related transactions.

What does BK 7 Petit mean?

BK 7-PETIT. Bankruptcy Chapter 7 (liquidation) Petition.

Is AB good for business credit?

ScoreRating901-990A801 – 900B701 – 800C601 – 700D

Can someone run your credit report without you knowing about it explain?

The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission. The circumstances surrounding the release of your financial information vary widely.

How many points does a soft inquiry affect credit score?

In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores. For perspective, the full range for FICO Scores is 300-850.

Does Credit Karma hurt your score?

Checking your free credit scores on Credit Karma doesn’t hurt your credit. These credit score checks are known as soft inquiries, which don’t affect your credit at all. Hard inquiries (also known as “hard pulls”) generally happen when a lender checks your credit while reviewing your application for a financial product.

How many points does your credit score go down when you are rejected?

The drop in your credit score is often insignificant and roughly 5 points. The impact decreases over time despite inquiries remaining on your credit report for two years.

Can a delinquency be removed?

Late payments remain in your credit history for seven years from the original delinquency date, which is the date the account first became late. They cannot be removed after two years, but the further in the past the late payments occurred, the less impact they will have on credit scores and lending decisions.

How do I remove delinquency from my credit report?

- Submit a Dispute to the Credit Bureau.

- Dispute With the Business That Reported to the Credit Bureau.

- Send a Pay for Delete Offer to Your Creditor.

- Make a Goodwill Request for Deletion.

How many points will my credit score increase when I pay off collections?

Contrary to what many consumers think, paying off an account that’s gone to collections will not improve your credit score. Negative marks can remain on your credit reports for seven years, and your score may not improve until the listing is removed.

Is it better to have a 0 balance on your credit card?

The standard recommendation is to keep unused accounts with zero balances open. A zero balance on a credit card reflects positively on your credit report and means you have a zero balance-to-limit ratio, also known as the utilization rate. Generally, the lower your utilization rate, the better for your credit scores.

What is the required credit score to buy a house?

Conventional Loan Requirements It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, you might be offered a higher interest rate.

Can you get a home loan with 700 credit score?

A 700 credit score meets the minimum requirements for most mortgage lenders, so it’s possible to purchase a house when you’re in that range. … A credit score of 700 also might not qualify you for the best interest rate on your mortgage loan, you may still want to work on improving your credit scores to save on interest.

What does C1 mean on credit report?

C1 indicates a line of credit that has been paid as agreed. The “C” is an abbreviation for a line of credit and the “1” indicates the manner of payment, paid according to the agreement.