The seller on a land contract can enjoy a regular cash flow without the headaches of managing rental property. The seller may be able to realize a greater overall profit from the sale by earning interest. The seller may charge interest up to 11%.

- How is land contract interest calculated?

- How long can a land contract last in Michigan?

- What is the main disadvantage of a land contract to the seller?

- Who pays taxes on a land contract?

- Is interest paid on a land contract tax deductible?

- Are land contracts a good idea?

- How much is land interest?

- What are the disadvantages of a land contract?

- What is an advantage of a land contract to a seller?

- What's the difference between a mortgage and a land contract?

- Does a land contract have to be recorded in Michigan?

- Who owns the property in a land contract?

- What are the pros and cons of land contracts?

- How does capital gains tax work on a land contract?

- Does a land contract have to be recorded?

- What is the capital gain tax for 2020?

- Why are land contracts bad?

- Are land contracts legal?

- What is the Mother Hubbard clause?

- What is the capital gains tax rate for 2021?

- Which document is the most important at closing?

- What type of contract can have tax benefits for a seller?

- What is a land contract guarantee?

- Can you make monthly payments on land?

- Which loan is best for land?

- Can you get a 30 year loan on land?

- How can I pay off my land loan faster?

- How do I turn my land contract into a mortgage?

- Can you do a cash out refinance on a land contract?

How is land contract interest calculated?

To calculate the interest payment, multiply the amount financed by the interest rate, and divide the result by the number of installments in a year. For example, the monthly interest payment on a $200,000 land contract home with an 8% interest rate after a 10% down payment would be $1,200.

How long can a land contract last in Michigan?

A land contract commonly provides for a down payment around 10% of the purchase price, a term between 2 and 4 years, and a balloon payment of the remaining balance due at the end of the term.

What is the main disadvantage of a land contract to the seller?

Name four advantages of a land contract to the seller. With so many advantages for the seller, what is the main disadvantage? Buyer may have poor or no credit history which increases risk of buyer default.Who pays taxes on a land contract?

On a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller. However, the buyer does get to deduct them from his or her taxes; the seller cannot.

Is interest paid on a land contract tax deductible?

According to Internal Revenue Service Publication 936, the interest you pay on a land contract is tax deductible, just like the interest you pay on a traditional mortgage or deed of trust with a bank.

Are land contracts a good idea?

Yes. With the right circumstances and a fair document, a land contract (sometimes called a “contract for deed”) can be a great way to transfer real estate when traditional financing is not available. More often, we hear about terrible results from land contracts.

How much is land interest?

Land Type10-year fixed30-year fixedLot Land4%-5%4.65% – 5.65%Raw/Recreational Land4.25% – 5.25%4.90% – 5.90%What are the disadvantages of a land contract?

Disadvantage #1: The title does not automatically pass to the purchaser in a land contract. Disadvantage #2: The seller could be held legally responsible for inspection issues with local or state authorities. Disadvantage #3: Forfeiture of a land contract by the purchaser is a fairly common occurrence.

Does land contract affect credit score?A contract for deed — also known as a land contract — is nothing more than an installment contract between two parties. In a contract for deed, a homebuyer agrees to make regular payments to a home seller. … As a result, a buyer’s forfeiture of a contract for deed wouldn’t affect his credit negatively.

Article first time published onWhat is an advantage of a land contract to a seller?

A land contract lets the seller enjoy a steady cash flow without the hassles of managing it as rental property, and also offers an asset or equity interest in exchange for other property.

What's the difference between a mortgage and a land contract?

A land contract is a fairly simple concept. Basically, the seller is financing the purchase instead of going through a mortgage lender. Instead of taking out a mortgage, the buyer agrees to make regular payments directly to the seller, who still retains title to the property.

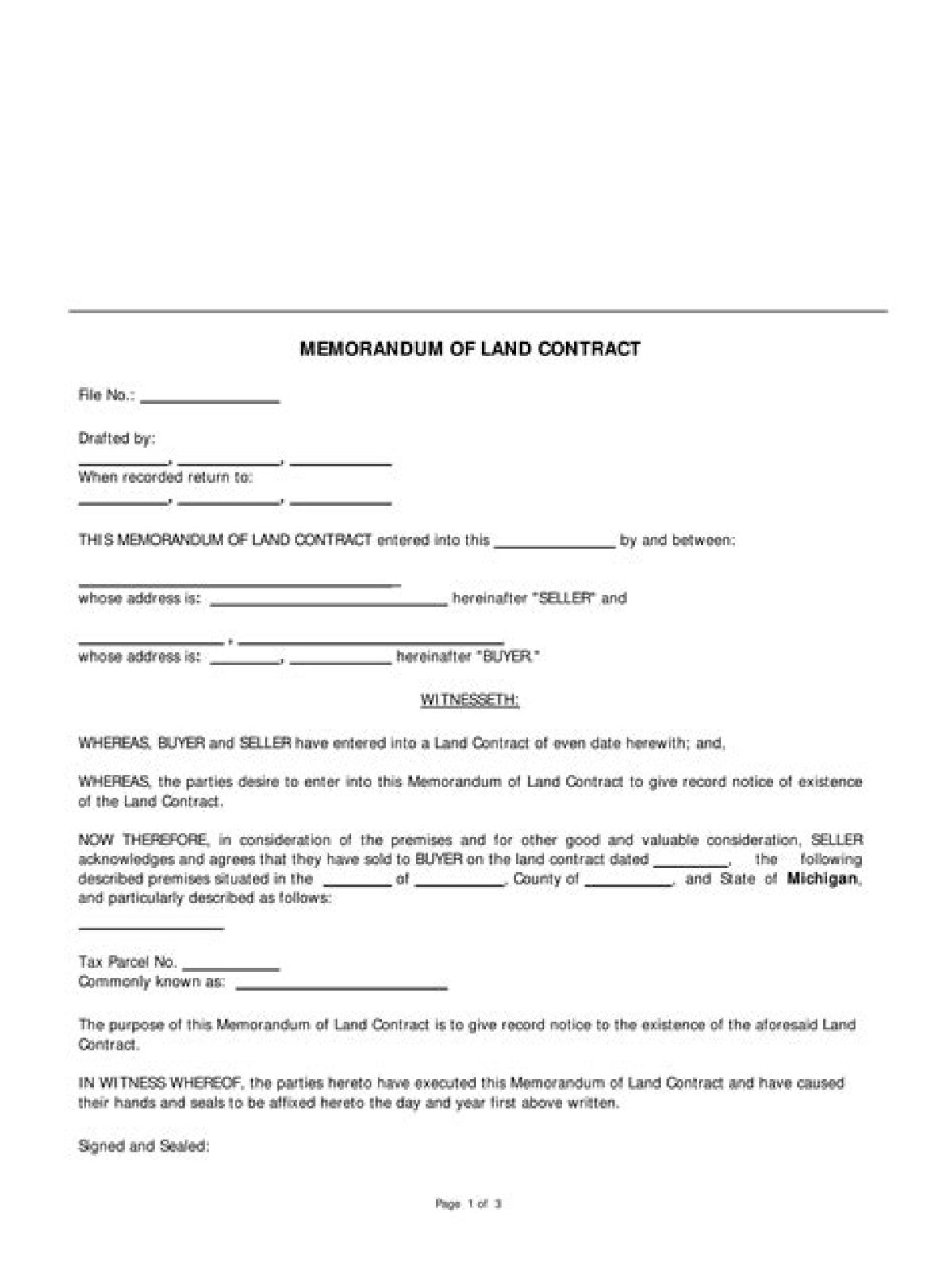

Does a land contract have to be recorded in Michigan?

Registering a Land Contract A land contract is not legally required to be recorded in Michigan. However, both the buyer and the seller may wish to record the contract to protect their interests in the property. … The land contract should be signed in front of a notary public or local judge.

Who owns the property in a land contract?

In a traditional land contract, the seller keeps the legal title to the property until the land contract is fully paid off. Meanwhile, the buyer gets equitable title, which enables them to build up equity in the property.

What are the pros and cons of land contracts?

- Pro: Financing. …

- Pro: Win-Win For Seller. …

- Pro: A Sales Tool In A Tough Market. …

- Con: Buyer Depends On Seller. …

- Con: Contract Mistakes. …

- Con: The Buyer Could Feel Like The Owner.

How does capital gains tax work on a land contract?

Federal Tax Treatment of the Land Contract Assuming that the property was sold at a profit, the principal payments are taxed as capital gains at 15 percent or the rate that is in effect at the time of the payment, until the balance is paid down to the property’s basis. At that point, the principal payments are untaxed.

Does a land contract have to be recorded?

Important transactions such as the purchase of real property have to be on record in order to be binding. This not only helps sellers ensure that the terms of the sale are enforced, it also protects buyers from unscrupulous sellers who might resell land that has already been purchased under a land contract.

What is the capital gain tax for 2020?

Capital Gains Tax RateTaxable Income (Single)Taxable Income (Married Filing Separate)0%Up to $40,000Up to $40,00015%$40,001 to $441,450$40,001 to $248,30020%Over $441,450Over $248,300

Why are land contracts bad?

Here are some of the risks: The seller retains the right to the property until you pay in full, no matter how much money you put into it. If you miss any payments, the seller can quickly cancel the contract and keep every cent you’ve paid (state laws vary on how this goes down)

Are land contracts legal?

A land contract is a legal agreement where the owner finances the buyer’s purchase of a piece of real estate. Despite its name, a land contract isn’t necessarily an agreement to purchase a vacant parcel (though it can be).

What is the Mother Hubbard clause?

A Mother Hubbard clause is a catchall in a deed to capture small, overlooked, or incorrectly described interests. A Mother Hubbard clause is not effective to convey a significant property interest not adequately described in the deed.

What is the capital gains tax rate for 2021?

For example, in 2021, individual filers won’t pay any capital gains tax if their total taxable income is $40,400 or below. However, they’ll pay 15 percent on capital gains if their income is $40,401 to $445,850. Above that income level, the rate jumps to 20 percent.

Which document is the most important at closing?

The most important originals are the purchase agreement, deed, and deed of trust or mortgage. In the event originals are destroyed, you might be able to get certified copies of these documents from the lender or closing company, but you don’t want to rely on others’ recordkeeping systems unless you have to.

What type of contract can have tax benefits for a seller?

Seller Tax Benefits The IRS allows contract for deed home sellers to control how their capital gains is reported. Capital gains resulting from a contract for deed home sale can be reported over the years you receive principal payments from your buyer.

What is a land contract guarantee?

The Land Contract Guarantee Program, administered by the U.S. Department of Agriculture’s (USDA) Farm Service Agency (FSA), provides federal loan guarantees to retiring farmers who self-finance the sale of their land to beginning farmers, farmers of color, and women farmers.

Can you make monthly payments on land?

Thus an investment in land with cheap monthly payments can offer security, future financial rewards, and a hedge against economic inflation.

Which loan is best for land?

The Bottom Line The more improved the land, the lower your required down payment and borrowing costs will be. The best options to finance a land purchase include seller financing, local lenders, or a home equity loan. If you are buying a rural property be sure to research if you qualify for a USDA subsidized loan.

Can you get a 30 year loan on land?

Lenders require a larger down payment for a land loan as opposed to a traditional home mortgage loan. … Land loans with no home on the land are capped at 15 years through MidAtlantic Farm Credit, while home mortgages can go up to 30 years. Land loans are typically more expensive than purchasing a prebuilt home and land.

How can I pay off my land loan faster?

- Make bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks. …

- Round up your monthly payments. …

- Make one extra payment each year. …

- Refinance. …

- Boost your income and put all extra money toward the loan.

How do I turn my land contract into a mortgage?

FHA Mortgage Financing Federal Housing Administration mortgages frequently are the easiest way for land contract homeowners to obtain a mortgage with no down payment. Generally, homeowners with land contracts may apply for either purchase mortgages from the FHA or for refinancing that creates an FHA mortgage.

Can you do a cash out refinance on a land contract?

For conforming (Fannie Mae and Freddie Mac) loans, you cannot do a cash-out refinance when paying off a land contract. … You can do a cash-out refinance on FHA LOANS, VA HOME LOANS AND CONVENTIONAL LOANS. 85% LTV on cash-out FHA LOANS, 80% on CONVENTIONAL LOANS and 100% on VA LOANS.