Qualified widow or widower is a tax filing status that allows a surviving spouse to use the married filing jointly tax rates on their tax return. The survivor must remain unmarried for at least two years following the year of the spouse’s death to qualify for the tax status.

- Which of the following is are among the requirements to enable a taxpayer to be classified as a qualifying widow er?

- What is the standard deduction for qualifying widow 2021?

- When a husband dies what is the wife entitled to?

- What are the requirements for qualifying widower?

- Who qualifies as head of household for IRS?

- Are you still a MRS after husband dies?

- What is a second wife entitled to?

- Does beneficiary override spouse?

- Is it better to file as qualifying widow or head of household?

- How are taxes affected when spouse dies?

- What's the 2021 tax brackets?

- Which of the following criteria is necessary to qualify as a dependent of another taxpayer?

- What is the filing status for a widow?

- How much tax does a widow pay?

- What is your title if you are a widow?

- Do you still wear your wedding ring when widowed?

- Is a widow considered married or single?

- What do I file if my spouse filed head of household?

- What is a qualifying dependent?

- What is a qualifying dependent IRS?

- Who you should never name as beneficiary?

- What is a spousal waiver?

- How many years do you have to be married to get your spouse's 401k?

- Can an ex wife get widow benefits?

- Who are the legal heirs of second wife?

- Does second wife get husband Social Security?

- What are the rights of a surviving spouse?

- Does spouse automatically inherit bank account?

- What is the standard deduction for widow over 65?

Which of the following is are among the requirements to enable a taxpayer to be classified as a qualifying widow er?

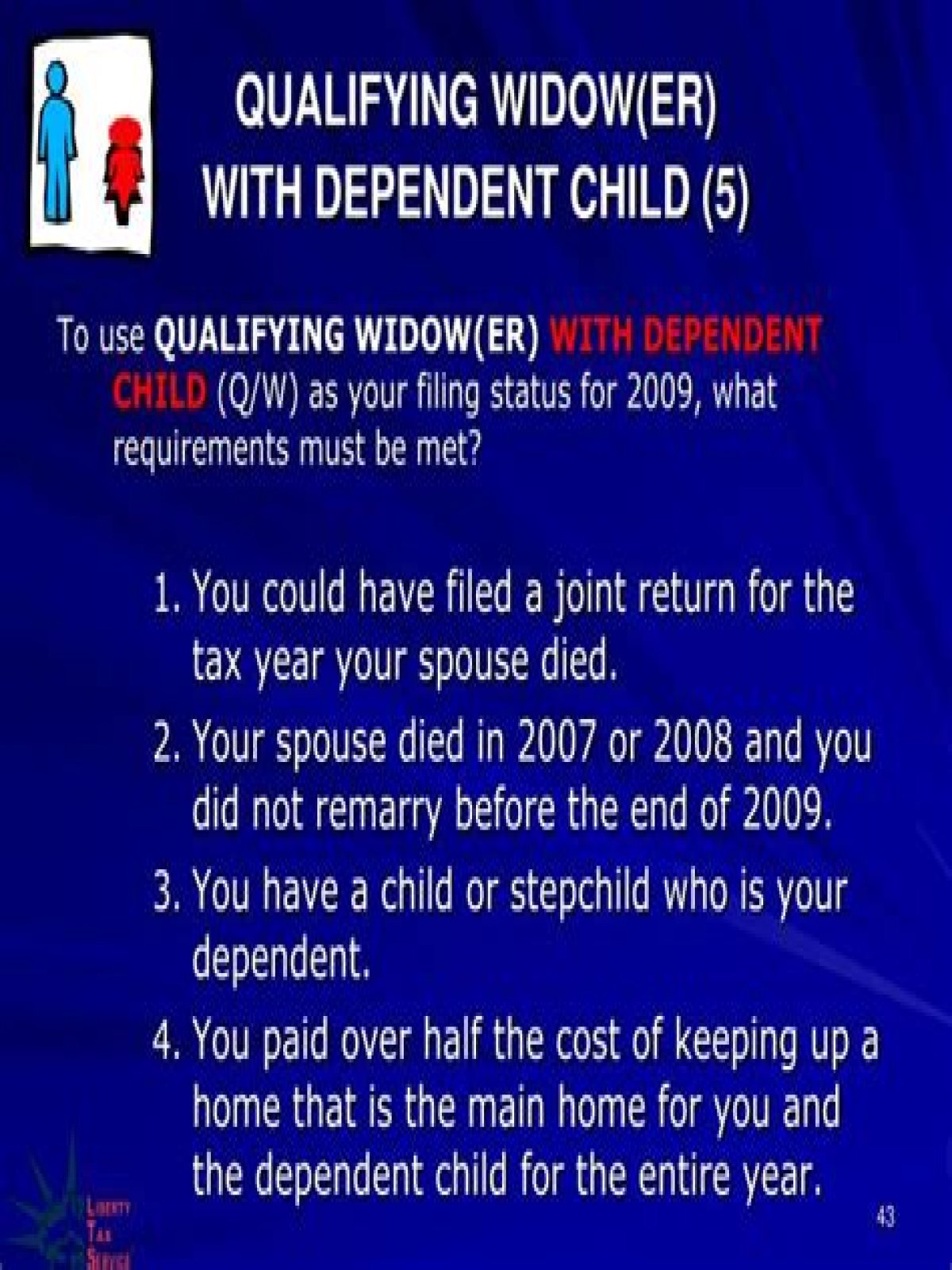

The requirements that enable a taxpayer to be classified as a “qualifying widow(er)” are: 1. The taxpayer’s spouse died in one of the two previous years and the taxpayer did not remarry in the current year. 2.

What is the standard deduction for qualifying widow 2021?

The 2021 standard deduction for a qualified widow(er) is $25,100.

When a husband dies what is the wife entitled to?

Upon one partner’s death, the surviving spouse may receive up to one-half of the community property. If there is no will or trust, then surviving spouses may also inherit the other half of the community property, and take up to one-half of the deceased spouse’s separate property.What are the requirements for qualifying widower?

- You qualified for married filing jointly with your spouse for the year he or she died. …

- You didn’t remarry before the close of the tax year in which your spouse died.

- You have a child, stepchild, or adopted child you claim as your dependent. …

- You paid more than half the cost of maintaining your home.

Who qualifies as head of household for IRS?

To claim head-of-household status, you must be legally single, pay more than half of household expenses and have either a qualified dependent living with you for at least half the year or a parent for whom you pay more than half their living arrangements.

Are you still a MRS after husband dies?

Although there are no legal, grammatical, or lexicographical rules governing what courtesy title is “correct” for a widow, in general, when a woman’s husband dies, she retains the title of Mrs. … But, when in doubt, stick with Mrs. — or just ask.

What is a second wife entitled to?

Your second spouse typically will be able to claim one-third to one-half of the assets covered by your will, even if it says something else. Joint bank or brokerage accounts held with a child will go to that child. Your IRA will go to whomever you’ve named on the IRA’s beneficiary form, leaving your new spouse out.Does beneficiary override spouse?

Generally, no. But exceptions exist Typically, a spouse who has not been named a beneficiary of an individual retirement account (IRA) is not entitled to receive, or inherit, the assets when the account owner dies.

Does the first wife get everything when husband dies?When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will. … Because the surviving spouse becomes the outright owner of the property, he or she will need a Will to direct its disposition at his or her subsequent death.

Article first time published onIs it better to file as qualifying widow or head of household?

The tax rates for qualified widows or widowers are the same as for couples filing a joint return and are lower than the tax rates for a head of household. So if you are eligible to use the qualifying widow(er) status, you should do so.

How are taxes affected when spouse dies?

For two tax years after the year your spouse died, you can file as a qualifying widow or widower. This filing status gives you a higher standard deduction and lower tax rate than filing as a single person. … You must have been able to file jointly in the year of your spouse’s death, even if you didn’t.

What's the 2021 tax brackets?

There are seven tax brackets for most ordinary income for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket depends on your taxable income and your filing status: single, married filing jointly or qualifying widow(er), married filing separately and head of household.

Which of the following criteria is necessary to qualify as a dependent of another taxpayer?

Which of the following criteria is necessary to qualify as a dependent of another taxpayer? Must be considered either a qualifying child or relative. Must be a citizen of the US, Canada, or Mexico.

What is the filing status for a widow?

Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse’s death. You must have a dependent child in order to file as a Qualifying Widow or Widower.

How much tax does a widow pay?

20202021Taxes Per Person$2,631.50$7,882

What is your title if you are a widow?

You can use any title you wish. You might like to be called “Mrs.” even after divorce, or you may prefer “Ms” or “Miss”.

Do you still wear your wedding ring when widowed?

Many widows or widowers choose to continue to wear their wedding ring for some time. Some wear it for the rest of their life. They might do it because it makes them feel safe. … Tip: There is no time frame for when you should stop wearing your wedding ring.

Is a widow considered married or single?

Whether you consider yourself married as a widow, widower, or widowed spouse is a matter of personal preference. Legally you are no longer married after the death of your spouse.

What do I file if my spouse filed head of household?

To qualify for the head of household filing status while married, you must be considered unmarried on the last day of the year, which means you must: File your taxes separately from your spouse. Pay more than half of the household expenses. Not have lived with your spouse for the last 6 months of the year.

What is a qualifying dependent?

A Qualifying Relative is a person who meets the IRS requirements to be your dependent for tax purposes. If someone is your Qualifying Relative, then you can claim them as a dependent on your tax return. Despite the name, an IRS Qualifying Relative does not necessarily have to be related to you.

What is a qualifying dependent IRS?

To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a “student” younger than 24 years old as of the end of the calendar year. There’s no age limit if your child is “permanently and totally disabled” or meets the qualifying relative test.

Who you should never name as beneficiary?

Whom should I not name as beneficiary? Minors, disabled people and, in certain cases, your estate or spouse. Avoid leaving assets to minors outright. If you do, a court will appoint someone to look after the funds, a cumbersome and often expensive process.

What is a spousal waiver?

A Member’s spouse uses the Spousal Waiver Form to waive his/her legal right to pension benefits after the Member’s death. If the Member wishes to select a form of pension that doesn’t provide income to his spouse after the Member dies, then the spouse must complete this form prior to the Member’s retirement.

How many years do you have to be married to get your spouse's 401k?

To receive a spouse benefit, you generally must have been married for at least one continuous year to the retired or disabled worker on whose earnings record you are claiming benefits.

Can an ex wife get widow benefits?

If your former spouse has died, you may be entitled to Social Security survivor benefits as a former spouse if you meet the following requirements: Your marriage lasted at least ten years. You’re at least 60 years old, or 50 if disabled. You haven’t remarried before the age of 60.

Who are the legal heirs of second wife?

If the second wife is legally married, she has all the rights and a share in the property of the deceased husband, as she is a class I legal heir along with her offspring as per the Hindu Succession Act, 1956.

Does second wife get husband Social Security?

As a spouse, you have the option of claiming a Social Security retirement benefit based on your own earnings record or collecting a spousal benefit equal to half of your spouse’s Social Security benefit.

What are the rights of a surviving spouse?

The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate. The spouse has this right in addition to any inheritance the spouse gets under the laws of intestacy.

Does spouse automatically inherit bank account?

If your wife set up a payable-on-death or transfer-on-death account, the contents of the account go to whomever she names as beneficiary. … Even if you’re not the beneficiary, you may have a claim on at least half the money, if your wife opened the account during your marriage and it contained marital funds.

What is the standard deduction for widow over 65?

Taxpayers who are 65 and Older or are Blind Single or Head of Household – $1,700 (increase of $50) Married taxpayers or Qualifying Widow(er) – $1,350 (increase of $50)