Special event insurance is an insurance policy that helps protect your investment in a specific event, such as a wedding. Event insurance may help cover your costs if you unexpectedly need to cancel your event or if you’re found responsible for property damage or an injury caused during your event.

- What is event insurance and why is it so important?

- How long does event insurance last?

- What are some events that you might need specialized coverage for?

- What is the purpose of event cancellation insurance?

- What are special form perils?

- Do you need insurance to run an event?

- What are the types of event insurance?

- What is a specific coverage?

- When can you get wedding insurance?

- Which of the following would not be covered by event cancellation insurance?

- What is event cancellation and disruption insurance?

- Does travel insurance cover event cancellation?

- What kind of insurance do you need for a festival?

- How much does public liability insurance cost for an event?

- What type of insurance do event planners need?

- What is a special form policy?

- What is the difference between basic and special form insurance?

- Is wind and hail included in special form?

- What is the difference between Broad and special coverage?

- What are the 4 types of insurance?

- What is ISO special form property insurance?

- How do you price an event?

- Does wedding insurance Cover things already booked?

- Does wedding insurance Cover a breakup?

- Can you insure a wedding dress?

- Does Wedding Insurance Cover death of family member?

- How do you write a cancellation email event?

- What is non appearance event insurance?

- What is public liability insurance UK?

What is event insurance and why is it so important?

Event insurance protects event planners from a variety of mishaps in several specific areas of focus. There is general liability insurance and more specific coverage’s protecting against a range of potential problems that could negatively impact an event all the way up to and including cancellation.

How long does event insurance last?

Special Event Liability Coverage Keep in mind that liability coverage is usually limited to a 24- to 48-hour period that ends when the reception is over. Coverage limits may vary by policy, so be sure to read yours so that you know how much your insurance covers.

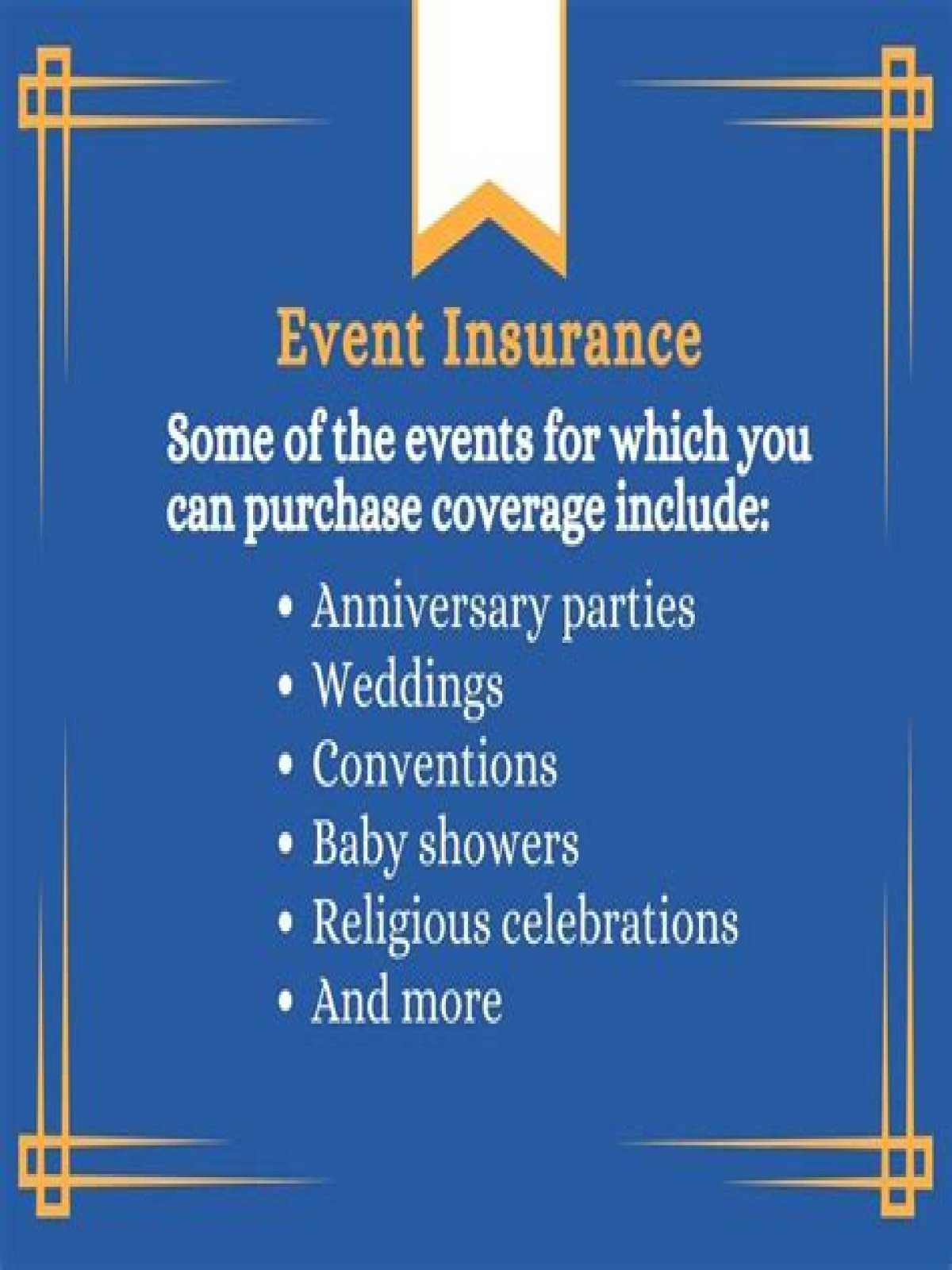

What are some events that you might need specialized coverage for?

- Bankruptcy.

- Closure of a financial institution.

- Death or physical disability.

- Destruction of accounting records.

- Political instability in a foreign country.

What is the purpose of event cancellation insurance?

Event cancellation insurance can help reimburse you for the loss of nonrefundable down payments for expenses like catering, flowers, photography, entertainment or honeymoon travel if your event is canceled or postponed. You may also be protected if a paid vendor goes out of business before your event.

What are special form perils?

Special Perils — property insurance that insures against loss to covered property from all fortuitous causes except those that are specifically excluded. This method of identifying covered causes of loss in a property policy has traditionally been referred to as “all risks” coverage.

Do you need insurance to run an event?

Regardless of the type of event you are organising it is always worth taking out protection for it. Most insurance policies will protect you against accidental damage, loss and theft of the equipment that is vital to the smooth operation of your event.

What are the types of event insurance?

- General liability.

- Professional liability.

- Inland marine.

- Special event.

- Liquor liability.

- Event cancellation.

- Workers’ comp.

- Commercial auto.

What is a specific coverage?

Specific insurance is a type of property insurance in which only one individual property is covered by the policy. Specific insurance is an alternative to blanket coverage, in which a policy can cover many different properties or locations.

Is Wedding Insurance a one time payment?Wedding insurance falls under special event coverage and usually comes in one-day, two-day and weekend length policies.

Article first time published onWhen can you get wedding insurance?

The accepted period of time between purchasing wedding insurance and the big day itself varies amongst providers although you can purchase a policy up to 2 years before the wedding. It’s a good idea to get cover in place once you start paying deposits and making arrangements.

Which of the following would not be covered by event cancellation insurance?

Event cancellation insurance does not cover losses caused by poor event planning, poor marketing, or lack of interest.

What is event cancellation and disruption insurance?

What is Event Cancellation Insurance or Disruption Insurance? Cancellation Insurance can compensate for your financial loss following cancellation, disruption, postponement or relocation of an event for reasons beyond your control.

Does travel insurance cover event cancellation?

What is Trip Cancellation Insurance? If you’re unable to take a trip due to an unforeseeable event, a trip cancellation policy will reimburse you for your prepaid, forfeited and non-refundable costs. Depending on the plan, your policy will help cover costs up to the time and date of your departure.

What kind of insurance do you need for a festival?

Public liability insurance Covers you if any festival goers get hurt or injured – or worse – while at the festival, as well as for third-party property damage.

How much does public liability insurance cost for an event?

Public liability insurance is crucial to protect you in case someone gets injured or has their property damaged on your property. $60 to $111 per month on average.

What type of insurance do event planners need?

General Liability Insurance for Event Planners Every event planner also needs general liability insurance. Just in case an exhibitor at a trade show you’re organizing is injured when they trip over a toolbox left by one of your contractors.

What is a special form policy?

Special Form Coverage These policy types offer the greatest protection. Unlike Basic and Broad Form Coverage, Special Form policies cover any type of sudden and accidental loss unless it is specifically excluded, such as earthquakes, backup of sewers and drains, and equipment breakdown.

What is the difference between basic and special form insurance?

Basic, Broad, and Special form are three common coverage forms when insuring property. Basic form is the most restrictive, while Special offers the greater level of protection.

Is wind and hail included in special form?

So-called “named peril” policies provide a laundry list of events for which coverage applies—fire, lightning, hail, vehicles, aircraft, windstorm, explosion, and vandalism, for example. … Put another way, special perils policies cover any cause of loss except what is excluded.

What is the difference between Broad and special coverage?

A broad form policy that adds more coverage, such as damage from broken windows and other structural glass, falling objects, and water damage. Special form coverage offers the widest range of protection, typically covering all risks (including theft) unless specifically excluded from the policy.

What are the 4 types of insurance?

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have. Always check with your employer first for available coverage.

What is ISO special form property insurance?

Special Causes of Loss Form — one of the three Insurance Services Office, Inc. (ISO), commercial property insurance causes of loss forms. Causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided.

How do you price an event?

Add the total cost of the food, venue, entertainment, and misc. expenses together and divide that number by the amount of people you want to attend. That will tell you the average cost for each attendee. Next, you’ll need to determine how much profit you want to make from the event to set your break-even point.

Does wedding insurance Cover things already booked?

If you don’t get the item/service from a pre-booked supplier (eg, florist, photographer), or it’s damaged, you’ll be covered for any deposits you’ve paid out and additional costs you incur.

Does wedding insurance Cover a breakup?

Whilst the break up of a relationship is clearly not going to be covered by wedding insurance, an unexpected illness in your family may well be and that could mean that any financial losses incurred will be covered by your insurance company.

Can you insure a wedding dress?

Additional or Special Coverages: If you want to insure your dress, or tuxedo, gifts, photographs or other items against damage or theft (i.e. if you rip your wedding dress accidentally).

Does Wedding Insurance Cover death of family member?

Policies usually define exactly what they mean by ‘close relatives’ in the policy wording, but usually include the death or illness of the bride, groom, civil partner, close family or key members of the wedding party – people without whom it would be inappropriate to go ahead with the wedding.

How do you write a cancellation email event?

- Choose the right format.

- Inform the recipients about cancellation.

- Give a reason why the event was cancelled.

- Write an apology for the cancellation.

- Issue terms of refund.

- End the letter with appreciation.

- Send the letter as soon as possible. Useful tools:

What is non appearance event insurance?

Non Appearance Insurance provides cover if the performer is unable to fulfil their obligations which in turn leads to the event being cancelled, abandoned, postponed, interrupted or relocated. Circumstances can include death, accident, serious illness or unavoidable travel delay.

What is public liability insurance UK?

Public liability is a type of insurance for businesses of all sizes, across a variety of industries. It covers you if a client or member of the public claims they have been injured, or their property damaged, because of your business activities. … It will also cover claims of property damage.