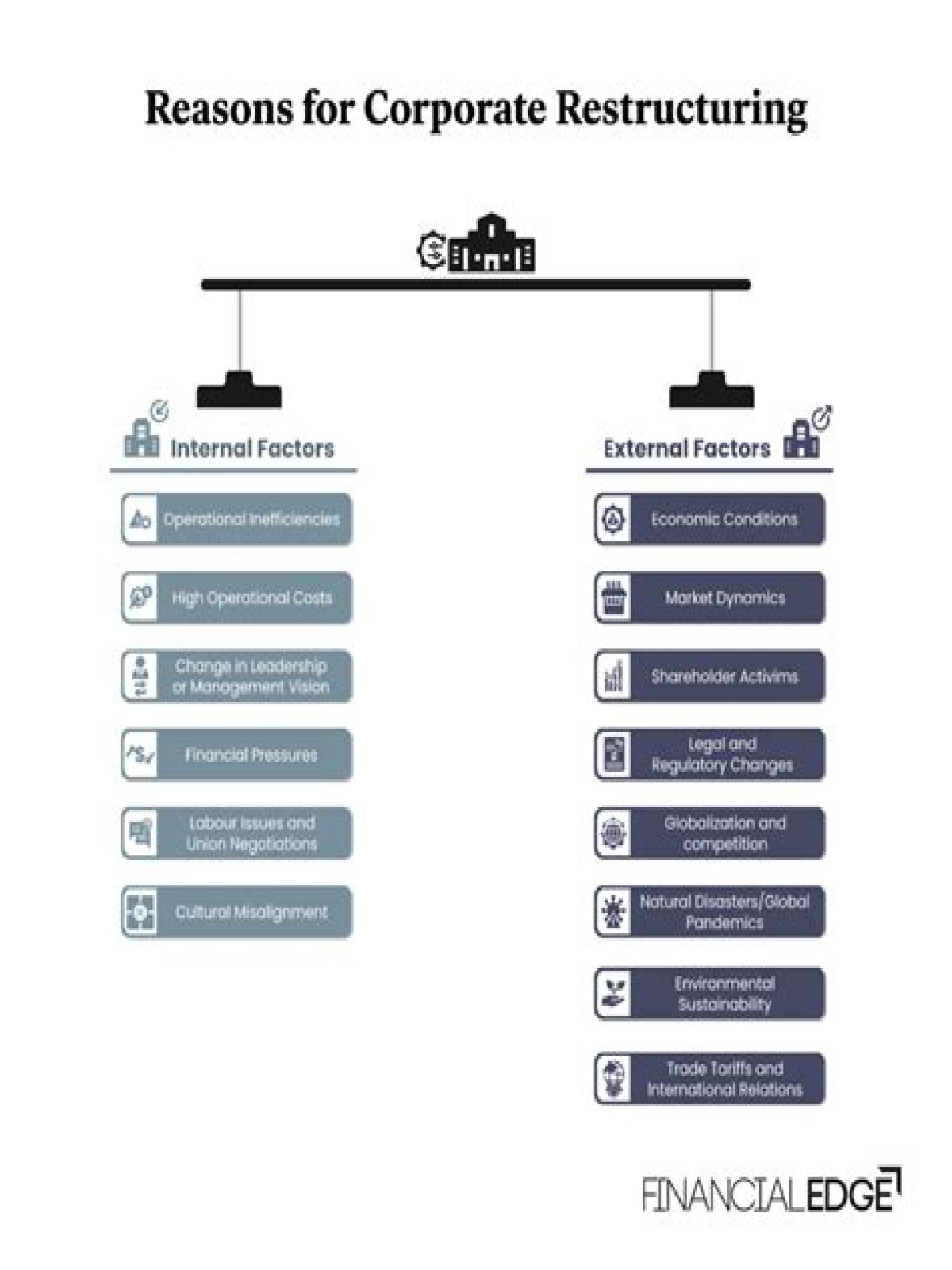

There are numerous reasons why companies might restructure, including deteriorating financial fundamentals, poor earnings performance, lackluster revenue from sales, excessive debt, and the company is no longer competitive, or too much competition exists in the industry.

- What are the reasons for corporate restructuring?

- What are the types of corporate restructuring?

- What is financial restructuring in corporate restructuring?

- What is financial reconstruction?

- Which services are provided by the corporate finance segment?

- What is corporate restructuring with example?

- What are the key components of the financial restricting schemes?

- What do you mean by corporate restructuring in company?

- What is corporate financial accounting?

- Why is corporate finance different from business finance?

- What are the 4 types of financial management?

- What are major components of financial management and what decisions are made by financial managers?

- What are the three main components of financial system of economy?

- What is corporate finance and why is it important?

- What are the advantages of corporate finance?

- What are the five basic corporate finance functions?

- What is the main objective of corporate finance?

- Why is corporate finance important to managers?

- What are the sources of corporate finance?

- What are financial and financial institutions?

- What is corporate finance and state two decisions basic of corporate finance?

- What is the difference between corporate finance and finance?

- What are 3 types of financial management?

- What are the three main functions of financial management?

- How useful financial strategy and financial planning in the organization?

- What is the purpose of financial management describe the kinds of activities that financial management deals with?

- What is financial management and objective of financial management?

What are the reasons for corporate restructuring?

- To reduce costs.

- To concentrate on key products or accounts.

- To incorporate new technology.

- To make better use of talent.

- To improve competitive advantage.

- To spin off a subsidiary company.

- To merge with another company.

- To decrease or consolidate debt.

What are the types of corporate restructuring?

- Mergers & Acquisitions. One of the best ways of increasing profitability in a business quickly is to incorporate an existing company into yours. …

- Divestment and Spin-Offs. …

- Debt Restructuring. …

- Cost Reduction. …

- Legal Restructuring.

What is financial restructuring in corporate restructuring?

Corporate restructuring entails any fundamental change in a company’s business or financial structure, designed to increase the company’s value to shareholders or creditor. … An example of financial restructuring would be to add debt to lower the corporation’s overall cost of capital.What is financial reconstruction?

Financial restructuring is the process of reshuffling or reorganizing the financial structure, which primarily comprises of equity capital and debt capital. Financial restructuring can be done because of either compulsion or as part of the financial strategy of the company.

Which services are provided by the corporate finance segment?

Corporate finance is concerned with how businesses fund their operations in order to maximize profits and minimize costs. It deals with the day-to-day operations of a business’ cash flows as well as with long-term financing goals (e.g., issuing bonds).

What is corporate restructuring with example?

For example, a corporate entity may choose to restructure their debt to take advantage of lower interest rates or to free up cash to invest in current opportunities. . … Two common examples of restructuring are in the sales tax and property tax arenas.

What are the key components of the financial restricting schemes?

The 3 main elements of an integral financial strategy are financial literacy or education, financial stability, and financial inclusion. Financial literacy or education refers to spreading awareness and knowledge about financial services that are given by banks and other financial institutions.What do you mean by corporate restructuring in company?

Corporate restructuring is an action taken by the corporate entity to modify its capital structure or its operations significantly. Generally, corporate restructuring happens when a corporate entity is experiencing significant problems and is in financial jeopardy.

What is corporate finance in financial management?Corporate finance refers to activities and transactions related to raising capital to create, develop and acquire a business. It is directly related to company decisions that have a financial or monetary impact. It can be considered as a liaison between the capital market and the organisation.

Article first time published onWhat is corporate financial accounting?

Corporate finance and accounting deal with financing, capital structure, business activity reporting, and analysis to help maximize returns and shareholder value.

Why is corporate finance different from business finance?

Corporate finance aims to maximize the value of the firm by optimizing the capital structure of the business, while financial management is more focused on maximizing profits with efficient planning and control of day-to-day operations.

What are the 4 types of financial management?

- 2.1 Treasury and Capital Budget Management.

- 2.2 Capital Structure Management.

- 2.3 Working Capital Management.

- 2.4 Financial Planning, Analysis and Control Management.

- 2.5 Insurance and Risk Management.

What are major components of financial management and what decisions are made by financial managers?

- Investment Decision: …

- Financing Decision: …

- Dividend Decision: …

- Working Capital Decision:

What are the three main components of financial system of economy?

Financial system functions include accumulating savings and lending funds. 36. Three financial system components are the U.S. Treasury, financial institutions, and financial markets.

What is corporate finance and why is it important?

Corporate finance is important for planning finances, capital raising, investments, and risk management and financial monitoring. If you assume that corporate finance is a function unconnected to the real operations of a company, you’d better think twice.

What are the advantages of corporate finance?

Corporate financing aims to increase the shareholder values that help managers to be able to balance capital funding between investments in projects that increase the long term profitability and sustainability of a company.

What are the five basic corporate finance functions?

The five basic corporate functions are financing (or capital raising), capital budgeting, financial management, corporate governance, and risk management. These functions are all related, for example, a company needs financing to fund its capital budgeting choices.

What is the main objective of corporate finance?

The primary goal of corporate finance is to maximize or increase shareholder value.

Why is corporate finance important to managers?

Why is corporate finance important to all managers? Corporate finance provides managers the ability to identify and select strategies, and projects. Additionally it allows for managers to forecast funding requirements for their company, and creates the ability to plan strategies for acquiring funds.

What are the sources of corporate finance?

Sources of corporate finance of business are equity, debentures, debt, retained profits, working-capital loans, term financing, letter of credit, venture funding and so forth. All source of corporate financing has always been used for different purpose at different situations.

What are financial and financial institutions?

Financial markets consist of agents, brokers, institutions, and intermediaries transacting purchases and sales of securities. … The term financial institution is a broad phrase referring to organizations which act as agents, brokers, and intermediaries in financial transactions.

What is corporate finance and state two decisions basic of corporate finance?

”corporate finance deals primarily with the acquisition and use of capital by business corporation. ” Two decisions that are the basis of corporate finance. Financing Decision: The business firm has access to the capital market to fulfill its financial needs.

What is the difference between corporate finance and finance?

Financial management includes the management of both assets and liabilities of the organization . Corporate Finance is a subset of Financial Management and it deals with raising of funds , management of liquidity and working capital and working on investments , among others .

What are 3 types of financial management?

Financial Management takes financial decisions under three main categories namely, investment decisions, financing decisions and dividend decisions.

What are the three main functions of financial management?

The three major functions of a finance manager are; investment, financial, and dividend decisions.

How useful financial strategy and financial planning in the organization?

Anticipating the future allows a company to prepare for things financially. Good financial planning helps a company maximize cash flow with pinpointed resource allocation and investment strategies.

What is the purpose of financial management describe the kinds of activities that financial management deals with?

Financial management is the practice of strategically planning, directing, organizing, and controlling financial events and resources within an organization. It is also the process of applying management approaches to tracking the financial assets of an organization.

What is financial management and objective of financial management?

Financial management involves planning, organizing, directing and controlling financial activities in an organization. … They ensure the basic objective of financial management is met by: Making important decisions through profit and loss analysis, financial forecasting and ratio analysis, among others.